|

BP - Annual F&O information - including pro forma data*

|

|

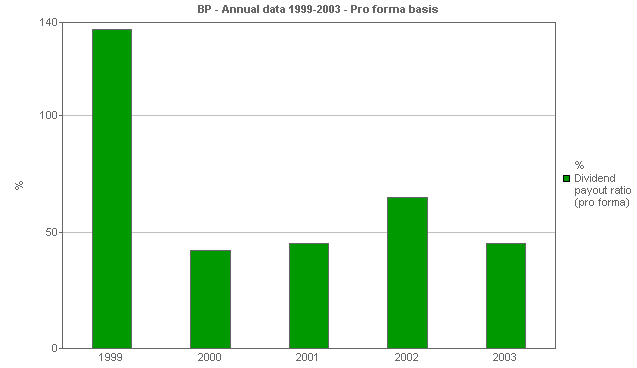

Ratios: Dividend payout

This bar chart shows dividend payout ratio (pro forma basis) and includes an average over the period.

|

|

|

|

|

|

Units

|

1999

|

2000

|

2001

|

2002

|

2003

|

|

Ratios - Pro forma basis - select from menu

|

|

|

|

|

|

|

|

Dividend payout ratio (pro forma)

|

%

|

137

|

42

|

45

|

65

|

45

|

All the financial data for 1999 to 2003 has been restated to reflect (i) the transfer of NGLs operations from E&P to GP&R and (ii) the impact of change in ESOP accounting. Only data for 2002 and 2003 has been restated to reflect the adoption by the group of "Retirement Benefits Reporting Standard (FRS17)"

|