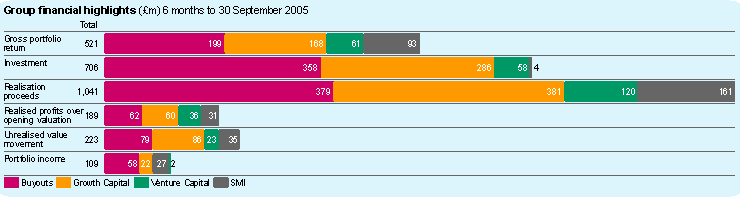

Our business lines

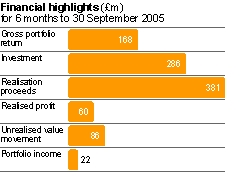

Buyouts

3i's mid-market Buyout business operates primarily on a pan-European basis, investing in businesses with a transaction value of up to €1 billion.

Gross portfolio return

13%

Portfolio value

£1,665m

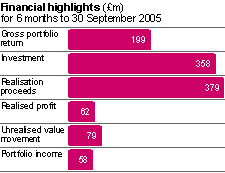

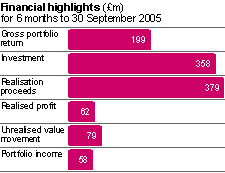

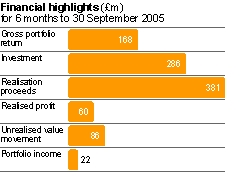

Growth Capital

3i's Growth Capital business makes minority investments in established and profitable businesses across Europe and Asia, typically investing between €10 million to €100 million per transaction.

Gross portfolio return

13%

Portfolio value

£1,321m

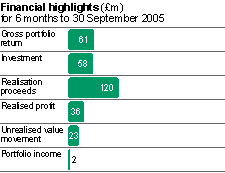

Venture Capital

3i's Venture Capital business operates on an international basis, with a focus on the software, communications, healthcare and electronics sectors, typically investing between €2 million and €10 million per transaction.

Gross portfolio return

8%

Portfolio value

£740m