- Profit from operations increased to £49 million compared to a loss of £21 million last year

- Strong operating and financial performance in Texas

- Significant contribution from EcoEléctrica in Puerto Rico

- Expectation for market recovery in both Texas and New England remains in the 2007-2009 timeframe

| Year ended 31 December 2005 |

Year ended 31 December 2004 |

|

|---|---|---|

| £m | £m | |

| Revenue | 694 | 260 |

| Profit/(loss) from operations | ||

| (before exceptional items) | 49 | (21) |

| Exceptional items | - | - |

| Profit/(loss) from operations | ||

| (post exceptional items) | 49 | (21) |

The Texas power market showed further signs of recovery during 2005 as pricing levels increased from the low levels in 2003 and 2004. Market prices improved driven by the demand for peak power (up 3% to 60,300 MW), a warm summer and a reduction in surplus generation following the retirements and mothballing of inefficient plant in 2004 and 2005. The current reserve margin in Texas is 24%, and we expect a further reduction this year. In Texas, gas fired generation typically sets the marginal price for power which means that the relatively high efficiency of our gas fired plants provides an economic advantage when gas prices are high.

| Assets in operation | Fuel/type | Gross capacity power MW |

Net capacity power MW |

Gross capacity heat (MWth) |

Net capacity heat (MWth) |

||

|---|---|---|---|---|---|---|---|

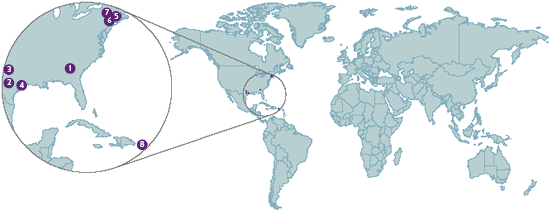

| Hartwell, Georgia | Gas (OCGT) | 310 | 155 | – | – | ||

| Hays, Texas(1) | Gas (CCGT) | 1,100 | 1,100 | – | – | ||

| Midlothian, Texas(1) | Gas (CCGT) | 1,650 | 1,650 | – | – | ||

| Oyster Creek, Texas | Gas (Cogen/CCGT) | 425 | 213 | 100 | 50 | ||

| Bellingham, Massachusetts(1) | Gas (CCGT) | 570 | 570 | – | – | ||

| Blackstone, Massachusetts(1) | Gas (CCGT) | 570 | 570 | – | – | ||

| Milford, Massachusetts | Gas (CCGT) | 160 | 160 | – | – | ||

| EcoEléctrica, Puerto Rico | LNG (CCGT) | 524 | 183 | – | – | ||

| North America total in operation | 5,309 | 4,601 | 100 | 50 |

(1) Capacity shown for these assets is the nameplate capacity.

In New England, the underlying reserve margin is now estimated at 20%. In this market, oil fired generation has a greater role in determining the market price of power, therefore the relatively high efficiency of our gas fired plants does not enjoy the same benefits of a high gas price environment as in Texas. Overall, spark spreads showed a smaller recovery than we experienced in Texas. Q1 2004 benefited from some very high, short duration, price spikes which lifted the full year spreads that year. Excluding this, the underlying spreads for 2005 were ahead of 2004.

In January 2006 the New England system operator reported progress on the establishment of a capacity payment mechanism (a Forward Procurement Market instead of the previously proposed LICAP system). The details of the proposed capacity market are expected to be disclosed in Q4 2006. This is a positive development for the New England market and is designed to ensure improved security of supply and encourage the provision of reliable generation, particularly at times of peak demand.

For 2006, approximately 60% of our expected output in Texas and approximately 30% of our expected output in New England has been forward contracted. Both markets have shown signs of recovery and our expectation for market recovery in both Texas and New England remains in the 2007-2009 timeframe. Operationally, the plants have performed well. We have also introduced an in-house outage team which has delivered both improved maintenance and service levels, and cost savings.

Midlothian

Midlothian, the 1,650 MW combined cycle gas turbine power station in Texas, is owned 100% by International Power and delivers its energy into the Texas ERCOT market (Electricity Reliability Council of Texas).

Midlothian is among the largest gas fired plants in the ERCOT market which has total capacity of 78,900 MW, including coal/lignite, nuclear, wind, hydro and gas fired plants. As older, less efficient plants in the ERCOT market have been retired or mothballed, the highly efficient and environmentally clean Midlothian plant has provided an increasing amount of power to the market. In 2005 the plant operated with a capacity factor of 55%.

Midlothian has received the Environmental Excellence award from the Texas Commission of Environmental Quality in recognition of its low emission combustion technology and its use of air cooling. This ensures efficient operation and minimises air emissions while using a fraction of the water normally used by similar sized generation units.

With its advanced, environmentally desirable design and operation, Midlothian will be a significant contributor to the ERCOT market for years to come.