This growth in earnings is primarily attributable to earnings from Paiton, which contributed its first full year of profits since its acquisition in December 2004. In 2005, Paiton consistently generated high levels of output and achieved availability levels significantly in excess of its PPA requirements.

- Profit from operations increased to £102 million (2004: £60 million) - up 70%

- First full year of earnings from Paiton, Indonesia

- HUBCO and KAPCO both delivered a good performance

| Year ended 31 December 2005 |

Year ended 31 December 2004 |

|

|---|---|---|

| £m | £m | |

| Revenue | 368 | 202 |

| Profit/(loss) from operations | ||

| (before exceptional items) | 102 | 60 |

| Exceptional items | - | - |

| Profit/(loss) from operations | ||

| (post exceptional items) | 102 | 60 |

| Assets in operation | Fuel/type | Gross capacity power MW |

Net capacity power MW |

Gross capacity heat (MWth) |

Net capacity heat (MWth) |

||

|---|---|---|---|---|---|---|---|

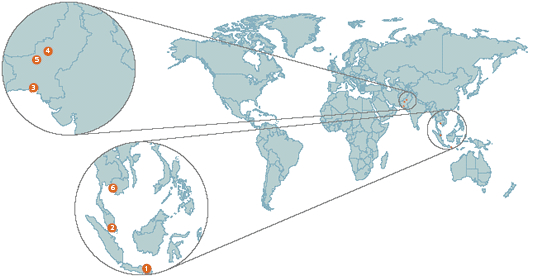

| Paiton, Indonesia | Coal | 1,230 | 385 | - | - | ||

| Malakoff, Malaysia(1) | Gas (OCGT/CCGT) | 3,130 | 567 | - | - | ||

| HUBCO, Pakistan | Oil | 1,290 | 214 | - | - | ||

| KAPCO, Pakistan | Gas/oil (CCGT) | 1,600 | 575 | - | - | ||

| Uch, Pakistan | Gas/oil (CCGT) | 586 | 234 | - | - | ||

| TNP (Pluak Daeng), Thailand | Gas (Cogen) | 120 | 120 | 7.7(2) | 7.7 | ||

| Asia total in operation | 7,956 | 2,095 | 7.7 | 7.7 | |||

| Assets under construction | |||||||

| Malakoff, Malaysia(1) | Coal | 1,890 | 342 | - | - | ||

| TNP (Pluak Daeng), Thailand | Gas (Cogen) | 23 | 23 | - | - | ||

| Asia total under construction | 1,913 | 365 | - | - |

(1)

Gross capacity amount shown for Malakoff represents the actual net interest owned directly or indirectly by Malakoff.

(2)

District cooling system capacity.

HUBCO and KAPCO in Pakistan continue to deliver a good performance. Both companies are listed on the Karachi Stock Exchange and as at 3 March 2006 the market value of International Power's shareholding in HUBCO and KAPCO totalled £186 million.

Uch, in Pakistan, delivered a solid contribution since acquisition in February 2005. Its fuel supplies were interrupted in early 2006 due to local civil unrest. However, the plant remained fully available on distillate fuel ensuring continuity of supply with no material financial impact. The pipeline was re-commissioned quickly and the plant continues to operate normally.

At Thai National Power (TNP), we are expanding our 120 MW plant by 23 MW to meet growing local demand for power. The construction of the expansion is expected to complete by the second half of 2006, and we have already refinanced the existing debt to provide the necessary funding.

At Malakoff in Malaysia the construction of the new-build coal fired 2,100 MW Tanjung Bin plant, in which Malakoff has a 90% interest, is on schedule to begin commercial operation in Q4 2006. In April 2005, Malakoff acquired a further 19% shareholding in the 1,303 MW CCGT Lumut power plant. This increased Malakoff's net installed capacity to 3,130 MW, which translates to net capacity of 567 MW for International Power. As at 3 March 2006 the value of International Power's shareholding in Malakoff was some £219 million.

KAPCO

KAPCO sells its total output to Pakistan's state utility, Water and Power Development Authority (WAPDA) under a 25-year power purchase agreement (PPA). International Power owns a 36% stake in KAPCO, while the government owns 44%, having sold 20% via an Initial Public Offering (IPO) in February 2005. KAPCO is a multi fuel power station which produces 85% of its electricity using natural gas and 15% from low sulphur fuel oil.

KAPCO plays a pivotal role in Pakistan's energy sector, supplying nearly 10% of the country's total electricity requirements. The combined cycle technology of the power plant enables it to deliver electricity efficiently and flexibly as required by its customer.

KAPCO is the only major plant in Pakistan with the ability to self-start in case of a countrywide blackout, and is the first in Pakistan to be awarded three key accreditations simultaneously: ISO 9001 -2000 Quality Management; ISO 14001 -1996 Environment Management; and OHSAS 18001 Occupational Health and Safety Management.