Remuneration Committee

Role and Membership

The Remuneration Committee (‘Committee’) is responsible

for recommending overall remuneration policy in respect of

the Executive Directors, the Chairman and senior managers.

The Board as a whole determines the remuneration of the

Non‑Executive Directors.

The Committee was chaired throughout the year by Leslie Atkinson. The other members of the Committee over the year were Keith Hamill (until his resignation from the Board on 18 July 2008), Tim Barker, Rupert Soames and Paul Hollingworth (following his appointment to the Board on 1 May 2008). The Chairman was invited to attend Committee meetings during the year. The Committee met four times during the year. Attendance by individual Committee members at meetings is detailed in the Corporate Governance report.

During the year ended 31 March 2009, the Committee adhered to the principles and provisions of the Combined Code as it applied during that year. In preparing this Report, the Board has followed the provisions of Section 1B of the Combined Code.

Advisers

For the year under review, the Committee has taken advice from

the following:

- Kepler Associates, who provided advice and data in respect of the remuneration of the Chairman, Executive and Non‑Executive Directors, the data required for the measurement of performance targets relating to the various executive share‑based plans, and advice regarding the setting of performance targets for the Long Term Incentive Plan (LTIP). Kepler Associates provided no other advice or services to the Company;

- the Chairman, Group Chief Executive and Group Finance Director, who have attended parts of meetings by invitation to advise on specific questions raised by the Committee and on matters relating to the performance and remuneration of senior managers;

- the General Manager – Group HR, who advised on remuneration of senior managers; and

- the Company Secretary, who acts as Secretary to the Committee.

Remuneration Policy

The remuneration policy has applied during the year ended 31 March 2009 and will continue to apply during the year ending 31 March 2010. The Committee keeps the Company’s policy under regular review, in order to meet its remuneration objectives described below.

Executive Directors

The objectives of the remuneration policy for Executive Directors

are to:

- provide a remuneration package which is competitive and linked to performance; and

- ensure that the Group can attract and retain executives who have the experience, skills and talents to manage and develop the business successfully.

The components of the remuneration package for Executive Directors are:

|

Fixed: |

Basic Salary; Pension; Other Benefits. |

|---|---|

|

Variable: |

Annual Bonus; Deferred Share Incentive Plan; Long Term Incentive Plan; Executive Incentive Plan. |

The Committee strives to ensure that shareholders’ interests are served by creating an appropriate balance between performance related and non‑performance related components of the remuneration package. In order to fulfil its objectives, the Committee believes that it is important to retain a certain amount of flexibility in structuring appropriate remuneration, for instance to facilitate the recruitment of suitably qualified candidates.

The Chairman and Non‑Executive Directors

Remuneration comprises an annual fee for the Chairman and

Non‑Executive Directors of the Company. An additional fee is

paid to the Chairmen of the Audit and Remuneration Committees.

The Chairman and Non‑Executive Directors do not participate

in the Company’s incentive or bonus schemes, nor do they

accrue any pension entitlement.

Remuneration Components for Executive Directors

Basic Salary

In determining salary levels, the Committee takes into account

the following:

- comparable information for similar job functions in companies of a similar size;

- the international spread and competitive nature of the Group’s businesses;

- the individual’s experience, performance and contribution in the areas for which responsibility is held;

- pay and conditions around the Group.

The Committee has decided that the Executive Directors will not receive an increase in basic salary in the financial year ending 31 March 2010. This is also the case for other senior managers in the Group.

Annual Bonus Plan

The Annual Bonus Plan aims to ensure that the incentives

for Executive Directors and senior managers are competitive

and closely aligned to the Company’s financial performance.

Cash: For Executive Directors, the plan links bonus to financial performance (80%), and personal achievement of non‑financial objectives (20%). The financial element is based on Group PBT, sales and cash flow. The performance targets are established by the Board and adopted by the Committee on an annual basis and reflect market conditions as well as strategic and operational factors. On‑target performance could earn a cash bonus of 50% of salary for each Executive Director, with a maximum cash bonus of 100% of salary.

Deferred shares: In the first half of the financial year, the Committee reviewed the overall remuneration package for Executive Directors and other senior managers. The review concluded that there was a need for an additional incentive opportunity for participants in the EIP (see below) after its expiry in respect of the financial year ended 31 March 2009. Following consultation with major shareholders in June 2008, the Committee agreed a deferred share element to the annual bonus plan. From March 2009, any cash bonus awarded will also attract deferred shares in Electrocomponents plc equivalent to 50% of the cash bonus. These deferred shares will be released after two years subject to continued employment. This effectively increases the overall on target bonus opportunity for Executive Directors to 75% of salary, and maximum to 150% of salary.

The Committee has discretion to vary bonus payments for participants but only in appropriate circumstances. Annual bonus payments are not pensionable.

Following consideration of the Group’s financial performance and in light of the cost reduction programme for the financial year ended 31 March 2009, it was determined that no bonus payments would generally be made across the Group. Consequently the Executive Directors were not awarded a bonus in respect of the financial year ended 31 March 2009.

Long Term Incentive Plan (‘LTIP’)

A conditional award of shares (an ‘Award’) was made to plan

participants under the LTIP in the year ended 31 March 2009.

The Award is subject to the performance condition detailed in the

paragraph below and is conditional on their continued employment

with the Group until the determination of the performance condition,

except in certain circumstances as explained below. The LTIP

is designed to align long‑term incentives with the interests of

shareholders and reflect current best practice. Participation in the

plan extends to Executive Directors and the Group’s senior managers.

Awards were made over a total of 1,594,600 ordinary shares in the

Company on 9 July 2008. The maximum value of Awards permissible

under the LTIP is 150% of basic salary for exceptional performance,

although in practice the Committee would normally award shares

up to a value of 100% of basic salary.

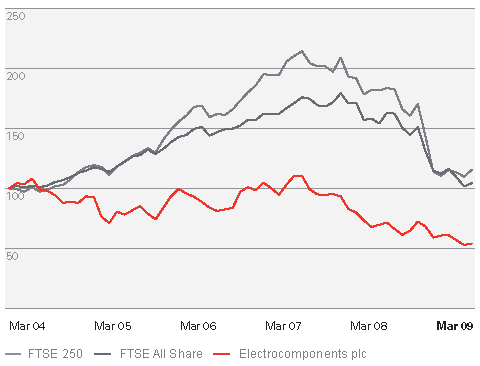

Vesting of Awards made in previous financial years under the LTIP were dependent upon Electrocomponents’ three year Total Shareholder Return (‘TSR’) percentage out‑performance of the FTSE 250 Index (the ‘Index’). Prior to making the Award in July 2008, the Committee reviewed the performance target. The revised target is for vesting of one half of the Award being conditional on TSR as described above. Vesting of the other half of the Award is conditional on growth in the Company’s nominal Earnings Per Share (‘EPS’).

For the part of the Award conditional on TSR to vest in full, the Company’s TSR must outperform the TSR of the Index by at least 20% over three years. If the Company’s TSR is equal to or below the TSR of the Index, none of this part of the Award will vest. Between these two levels this part of the Award will vest on a straight‑line basis.

For the part of the Award conditional on EPS to vest in full, the percentage increase in the Company’s EPS over the three year Performance Period must be at least 10% per annum. If the percentage increase in the Company’s EPS is 5% per annum or less, none of this part of the Award will vest. Between these two levels this part of the Award will vest on a straight‑line basis.

A cash payment, equivalent to the dividends that would have accrued on the number of shares that vest, will be made to participants on vesting.

For the Award to vest, the Committee must additionally be satisfied that there has been a sustained improvement in the Company’s underlying financial performance.

The Committee selected TSR and EPS as performance measures because it felt this would provide a good balance between external and internal measures of performance, as well as absolute and relative performance. TSR aligns performance with shareholders’ interests, and the FTSE 250 Index was chosen as the benchmark because Electrocomponents is a constituent of the Index and the Index is objective and transparent. EPS growth provides a measure of the profitability of the Company, reflecting more directly management performance and is a measure used by investors in deciding whether to invest in the Company.

Executive Incentive Plan (‘EIP’)

The EIP, which is limited to Executive Directors and members of the

Group Executive Committee, was a one‑off incentive plan designed

to reward achievement of the PBT targets set for the year ended

31 March 2009. The main conditional award of shares was made

on 1 February 2006. Further awards were made to new members

of the Group Executive Committee joining before 31 December 2007,

pro‑rated to the proportion of the full performance period they will

have been members of the Committee at the time of vesting.

No element of these awards has vested and on 29 May 2009 they lapsed in their entirety.

Long Term Incentive Share Option Plan (‘LTIOP’)

No awards have been made under the LTIOP since the year ended

31 March 2006 and there is no intention to make further awards

under this plan. Further information regarding the performance

targets are detailed

below.

Executive Shareholding Guidelines

Executive shareholding guidelines are in place which require

Executive Directors to retain at least 50% of any awards that vest in

order to help build‑up their personal holdings of Electrocomponents

plc shares to a value of 200% of salary for the Group Chief Executive

and 100% of salary for the Group Finance Director.

Savings Related Share Option Scheme

Executive Directors can participate in the Savings Related Share

Option Scheme, which is open to all UK employees. Performance

conditions have not been imposed, as they are not permissible

under UK HM Revenue & Customs rules for this type of scheme.

Dilution

Awards and options granted under the Company’s share plans are

generally satisfied by the issue of new shares. The Company has

an employee benefit trust which can also be used to provide shares

to satisfy share awards, by purchasing shares in the market. This

trust would be funded by the Company. The trust currently holds

308,417 (2008: 308,417) shares. The Company’s current dilution

levels are well within commonly accepted limits.

Electrocomponents Group Pension Scheme (‘the Scheme’)

Executive Directors participate in the section of the Scheme that

provides defined benefits on retirement. The Scheme operates

a Scheme specific earnings limit therefore maintaining a cap

on pensionable earnings (the ‘earnings cap’), which is

currently £117,600.

Annual salary considered for defined benefit pension purposes is restricted to increase at a maximum of 3% p.a. from June 2008, in line with the changes agreed with all members of the pension scheme. Salary awards above 3% attract normal Defined Contribution section benefits in line with other members of the Scheme.

Under the Scheme, the Directors benefit from the following provisions:

- a pension accrual rate of one‑thirtieth for each year of service;

- pension accrued after 1 June 2008 will be subject to a life expectancy risk sharing agreement, which was agreed with all members of the defined benefit section of the Scheme in 2008;

- a normal retirement age of 60;

- a pension on retirement of up to two‑thirds of pensionable earnings, or the earnings cap if lower;

- benefits drawn from the Scheme before normal retirement age are reduced to reflect the fact that they are paid sooner and for longer than anticipated. The reduction factors are calculated on a basis that is intended to be ‘cost neutral’ to the Scheme;

- in the event of death before retirement, a capital sum equal to four times basic salary is payable together with a spouse’s pension of two‑thirds of the member’s prospective pension at age 60 and children’s pensions if appropriate;

- in the event of death in retirement, a spouse’s pension of two thirds of the member’s pre‑commutation pension is payable; and

- pensions in payment or in deferment receive statutory increases annually in February. Additional increases are payable at the discretion of the Company and the trustee of the Scheme. No such increases have been awarded during the year.

Where the amount of a pension on retirement is limited by the earnings cap, arrangements have been agreed with individuals to compensate them for the reduction in benefits by salary supplement, details of which are included in a table shown here.

The following table gives details for each Director of:

- the annual accrued pension payable from normal retirement age, calculated as if they had left service at the year end i.e. 31 March 2009;

- the increase in accrued pension attributable to service as a Director during the year;

- the transfer value of the accrued benefit at the year end;

- the transfer value of the accrued benefit at the previous year end; and

- the increase in the transfer value over the period.

These amounts exclude any (i) benefits attributable to additional voluntary contributions; and (ii) actual members’ contributions.