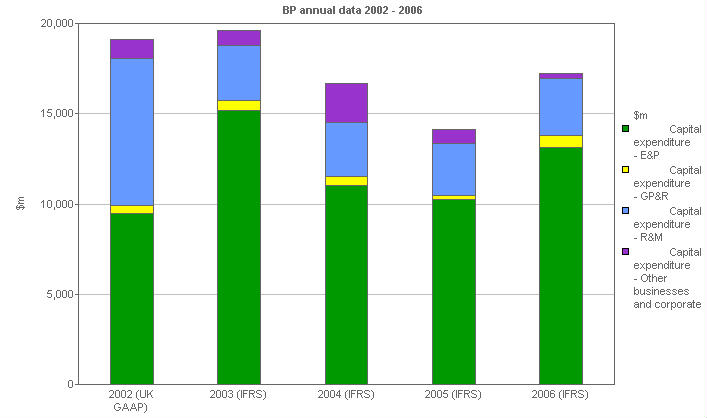

BP annual data homepage Replacement cost profit from continuing operations before interest and tax - Total Replacement cost profit from continuing operations before interest and tax - by business Net cash provided by operating activities Operating capital employed - by business Operating capital employed - by geographical area Capital expenditure - by business Capital expenditure - by geographical area Ratios - Debt ratios Ratios - ROACE Ratios - Dividend payout Dividends - pence per ordinary share Dividends - cents per ordinary share Dividends - US dollars per ADS BP performance vs comparatives - E&P vs BrentOil BP performance vs comparatives - E&P vs BP average oil realizations BP performance vs comparatives - R&M vs indicator margin BP performance vs comparatives - Gas vs Oil production BP performance vs comparatives - Finding & development costs BP performance vs comparatives - Lifting costs BP performance vs comparatives - Cost of supply BP performance vs comparatives - Net income per boe BP performance vs comparatives - Reserves replacement |

| |

© 1999-2007 BP p.l.c.