BP annual data homepage

Replacement cost profit from continuing operations before interest and tax - Total

Replacement cost profit from continuing operations before interest and tax - by business

Net cash provided by operating activities

Operating capital employed - by business

Operating capital employed - by geographical area

Capital expenditure - by business

Capital expenditure - by geographical area

Ratios - Debt ratios

Ratios - ROACE

Ratios - Dividend payout

Dividends - pence per ordinary share

Dividends - cents per ordinary share

Dividends - US dollars per ADS

BP performance vs comparatives - E&P vs BrentOil

BP performance vs comparatives - E&P vs BP average oil realizations

BP performance vs comparatives - R&M vs indicator margin

BP performance vs comparatives - Gas vs Oil production

BP performance vs comparatives - Finding & development costs

BP performance vs comparatives - Lifting costs

BP performance vs comparatives - Cost of supply

BP performance vs comparatives - Net income per boe

BP performance vs comparatives - Reserves replacement

|

|

|

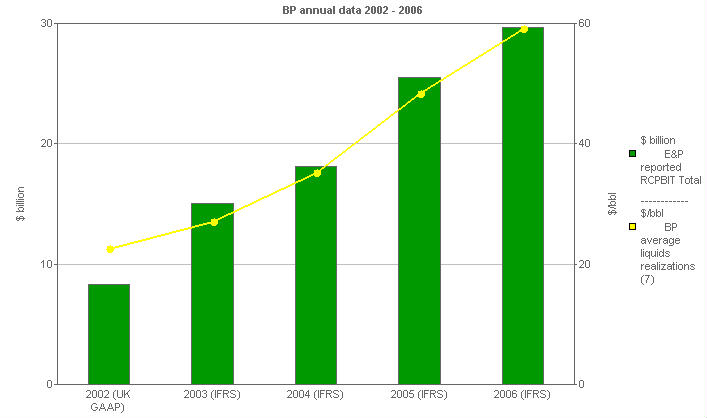

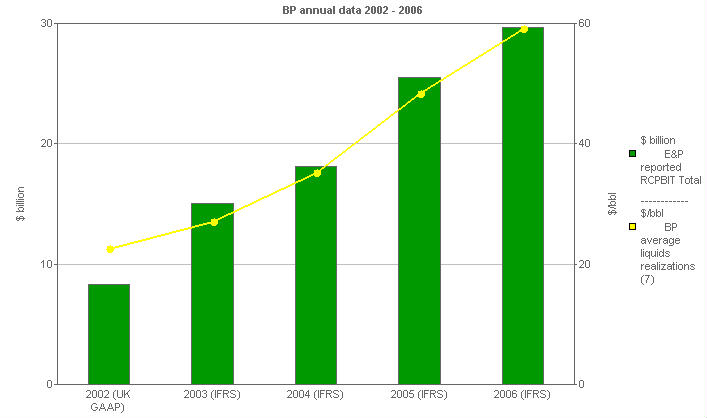

BP annual data 2002 - 2006

|

|

BP performance versus comparatives: E&P versus BP average oil realizations

This chart shows replacement cost profit before interest and tax of the Exploration and Production business segment (bar format, left hand scale), compared with BP average oil realizations (line format, right hand scale).

|

|

|

|

| |

Units |

2002 (UK GAAP) |

2003 (IFRS) |

2004 (IFRS) |

2005 (IFRS) |

2006 (IFRS) |

| E&P - comparatives & statistics |

|

|

|

|

|

|

| E&P RCPBIT and oil realizations |

|

|

|

|

|

|

| E&P reported RCPBIT Total |

$ billion |

8.277 |

15.081 |

18.077 |

25.49 |

29.65 |

| BP average liquids realizations (7) |

$/bbl |

22.69 |

27.25 |

35.39 |

48.51 |

59.23 |

The group adopted International Financial Reporting Standards (IFRS) with effect from 1 January 2005. Financial information for 2003 and 2004 has been restated to reflect the adoption of IFRS, as has the balance sheet at 1 January 2003, BP's date of transition to IFRS. BP chose not to adopt International Accounting Standard No. 39 'Financial Instruments: Recognition and Measurement' (IAS 39) until 1 January 2005, so financial assets and liabilities, including derivatives, are reported on the basis of UK generally accepted accounting practice (UK GAAP) for 2003 and 2004. The balance sheet at 1 January 2005 is also presented to show the effect of adopting IAS 39. The financial information for 2002 has not been restated for IFRS and remains on the basis of UK GAAP.

(7) Crude oil and natural gas liquids.

|

|