Remuneration Report

Introduction by Russell King, Remuneration Committee Chairman

On behalf of the Remuneration Committee, I am pleased to present the Directors' report on remuneration for 2010.

Despite the tough challenges faced by all companies in the last financial year, Aggreko's 2010 results demonstrate the strength of our business, the commitment and hard work of our employees, and the effective leadership of our executive team.

The Remuneration Committee has endeavoured to ensure that remuneration across our Company is fair and helps drive growth in profits and shareholder value over the short- and longer-term. We believe that executive remuneration decisions for 2010 reflect the executive team's success in achieving this growth.

Salaries for the executive team were frozen in 2009 to reflect the economic climate at that time. In 2010 the Committee increased salaries by between 3% and 20% for the Executive Directors to bring them a little closer to market median. This recognises the increased scale of the Company that has resulted from a greater than five-fold increase in its market capitalisation over the last five years.

In the coming year, the Committee will continue to review the Company's remuneration practices to ensure that they continue to help attract, retain and motivate talent we need, enabling further growth in value for Aggreko's shareholders.

The following report provides further detail of our current remuneration arrangements and outcomes for 2010. The report will be put to the shareholder vote at our AGM in April 2011 and we look forward to receiving your support.

Background

The Remuneration Report is one of the most keenly-studied parts of our Annual Report; we take the view that the processes around setting pay and performance are an important part of a Board's work, and shareholders will make judgements about the quality of governance of the Company as a whole when they read the Remuneration Report. We have therefore made an effort to make this report readable and clear, which is quite a hard task given the very considerable amount of regulation that, entirely appropriately, applies to this section.

First, the Directors confirm that we abide by all the rules. Specifically, the Company has complied with the Principles and underlying Provisions relating to Directors' remuneration of The Combined Code of Corporate Governance during 2010 and, for 2011 and later years, we intend to comply with its successor, The UK Corporate Governance Code and that this Remuneration Report has been prepared in accordance with the Large & Medium-sized Companies and Groups (Accounts and Report) Regulations 2008. Details of each individual Director's remuneration for 2010 are set out below. Information on Directors' share and share option interests may be found below.

The auditors are required to report on the 'auditable' part of this report and to state whether, in their opinion, that part of the report has been properly prepared in accordance with the Companies Act 2006 (as amended by the Regulations). The information which has been audited can be viewed below. No other parts of this report have been audited.

Responsibilities and role of the Remuneration Committee

The Committee's principal function is to determine the Company's policy on Board remuneration and to approve the specific remuneration packages for the Executive Directors and the Company Secretary, including their service contracts. The Committee also has responsibility for making a recommendation to the Board in respect of the remuneration of the Chairman. The Committee's remit therefore includes, but is not restricted to, basic salary, benefits in kind, performance related awards, share options and share awards, long-term incentive schemes, pension rights, and any compensation or termination payments.

The full Terms of Reference of the Committee are available on our website at www.aggreko.com/investors/corporategovernance.

Membership of the Committee

The members of the Committee during the year were as follows:

| Russell King | Chairman (from 1 September 2010) |

| David Hamill | |

| Ken Hanna | (appointed 21 October 2010) |

| Robert MacLeod | |

| Nigel Northridge | (resigned 31 August 2010) |

All of the members of the Committee are Independent Non-executive Directors. This is important because it means that the pay of the Executive Directors is set by people who are independent of the Executives, and who can come to sensible judgements as to what is in the interest of shareholders and fair to the Executives. Peter Kennerley is Secretary to the Committee and we consult both the Chairman and the Chief Executive and invite them to attend meetings when appropriate, but no Director is allowed to be present when his own remuneration is discussed. Our principal external advisers during the year were Hewitt New Bridge Street, who advised on revisions to and administration of the Company's share plans, and Kepler Associates to give advice on pay, benchmarking and other matters related to compensation. Neither Hewitt New Bridge Street, nor Kepler Associates, provide any other services to the Group.

Main activities of the Committee during the year

The main focus of the Committee's activity comprises managing the various aspects of the remuneration package of Executive Directors at Aggreko. This package comprises:

- annual salary;

- annual bonus;

- the Company's Long-term Incentive Programme (LTIP);

- pension and life assurance; and

- other benefits, including healthcare and expatriate benefits for Directors seconded away from their home country.

The Committee met four times during 2010; details of members' attendance are set out in the table in the corporate governance section.

The main tasks for the Committee were:

- reviewing and approving the Executive Directors' bonuses for 2009;

- setting targets and rules for Executive Directors' bonuses for 2010;

- reviewing and approving the vesting of the 2007 LTIP awards;

- reviewing and approving the rules and performance criteria for the 2010 LTIP grant;

- deciding on the level of pay increase in the annual salary review; and

- approving minor amendments to the rules of the LTIP to simplify their administration.

Remuneration policy

The Committee has adopted a number of principles which it applies to the way we set, balance and measure the different elements of the remuneration package for Executive Directors. In developing these policies the Committee is mindful of the views of the various bodies which opine on executive pay.

As a general policy, we aim to ensure that our remuneration policy rewards executives for delivering what we see as being their central responsibility, which is to increase the value of the business to shareholders consistently and over a long period of time. To achieve this we have structured the reward package with the following principles in mind:

- We want our Executives, and indeed all our employees, to feel fairly paid, and we do not want them to be easy prey for competitors who are hunting for talent. However, we don't want to waste money by over-paying. Accordingly, we aim to position our packages so that the fixed element of pay (i.e. salary, pension, and benefits) packages are around the median of that paid by companies of similar size and complexity.

- As far as the total reward package is concerned, we believe that shareholders support the concept of paying outstanding rewards for outstanding performance. We therefore have designed performance-related schemes that offer executives the opportunity to earn large rewards if they produce large increases in shareholder value. Concomitantly, they should not receive performance rewards if performance is mediocre.

More specifically:

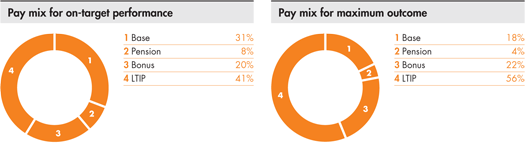

- We believe that Executive Directors should be able to earn more from their performance-related pay than from their fixed pay to encourage them to deliver superior performance.

- Within the performance-related pay element, we believe that Executive Directors should be able to earn more from long-term incentives than short-term incentives. The value to executives of delivering consistent growth over a three-year period should be greater than they can earn from their annual bonuses. This means that they are not motivated to deliver short-term gain at the cost of long-term value.

- These charts illustrate the mix of total remuneration for the Chief Executive for on-target performance and maximum remuneration:

- In terms of target-setting, we believe that we should try as far as we can to use measures which are closely aligned to those which deliver value for shareholders and which are independently auditable. We also believe that the targets should give clear 'line-of-sight' for the Executives (i.e. they know what they have to do to earn the money, and as far as possible, what they have to do is under their control); for this reason we prefer absolute, rather than relative measures. The targets set for annual bonuses and the Long-term Incentive Programme at Group level are Diluted Earnings per Share (D-EPS) and Return on Capital Employed (ROCE); both of these are Key Performance Indicators for the Company as described in the Key Performance Indicators section. We believe that if the Executives deliver growing D-EPS, at healthy rates of ROCE, the value of the Company to the shareholders will increase.

- Finally, we believe that there should be alignment in terms of the structure of performance pay schemes between the Executive Directors and the wider senior management team within Aggreko. We think it important that the entire senior management team is working towards the same targets and under the same schemes, and if the Executive Directors are doing well, the management team are doing well. We also take into account the pay and employment conditions of all employees of the Group when reviewing and setting executive remuneration.

These are the general principles of our current policy, which we intend to follow for 2011 and, subject to any changes in circumstances or best practices for future years.

Following these general principles, we set out below a description of how we have applied them to the various elements of remuneration in 2010.

Fixed pay

Annual salary

Annual Salaries for Executive Directors are generally reviewed each year by the Committee in June. Salaries are determined by a combination of the individual's contribution to the business and the market rate for the position. We aim to pay the market median for standard performance and pay up to the market upper quartile for upper quartile performance. On occasions it may be necessary to pay above the market median to attract people of the right calibre to meet the needs of the business. In setting annual salaries, as with other elements of remuneration, we have discretion to consider all relevant factors, including performance on environmental, social and governance issues.

The appropriate market rate is the rate in the market place from which the individual is most likely to be recruited. The Company operates in a number of market places throughout the world where remuneration practice and levels differ. This can result in pay and benefit differentials between the Executive Directors.

In arriving at an appropriate market rate, we commission studies from our advisers, who carry out in-depth research on the practices of Aggreko's peer group in the UK to establish accurate benchmarks. The same approach is taken for expatriate and overseas salaries where reference is made to the appropriate data for the geographical location.

Pensions

Pensions are based on current practice in the markets in which we operate and take into account long-term trends in pension provision. Further details on pension provision are set out below, but, in summary, Angus Cockburn is a member of the Aggreko plc Pension Scheme, which is a defined-benefit scheme. Messrs Soames, Caplan and Pandya, who joined the company after the Pension Scheme was closed to new entrants, benefit from a defined-contribution scheme. George Walker also has a defined-contribution scheme, but one which operates under US rules.

Benefits

All the Executive Directors receive health-care benefits and life assurance cover. Rupert Soames and Angus Cockburn receive the benefit of a company-funded car and George Walker receives a car allowance. Kash Pandya, who has been seconded from the UK to Dubai, receives an overseas secondment package which covers the cost of housing in Dubai and use of local facilities, a car allowance, and a contribution to school fees.

Performance-related pay

Annual Bonus Scheme

Generally, the outside world places great weight on the performance of the Company from year to year, and we therefore think it appropriate to have a significant, but not the greatest, part of the performance pay linked to annual performance. The purpose of the Annual Bonus Scheme is to align Executive Directors with this performance period and to motivate them to meet and beat demanding annual performance targets. The targets for the Annual Bonus Scheme are tied to the Annual Budgets set by the Board. Generally, bonuses will start to be earned at performance levels a few percentage points below Budget, increase sharply to Budget, and then increase until they reach capped levels, which will generally be at 10-15% above Budget. Executive Directors with regional management responsibilities (Messrs Pandya, Caplan and Walker) have half of their bonus related to the performance of their region (as measured by trading profit and return on capital employed) and half related to D-EPS. The Chief Executive's and Finance Director's bonuses are measured exclusively against D-EPS. In 2010 the on-budget bonus earnings was changed to 50% for all Executive Directors; accordingly the on-budget and maximum bonus earnings for the Executive Directors was

|

% of annual salary |

||

|

On-budget |

Maximum |

|

|

Rupert Soames |

50% |

125.0% |

|

Angus Cockburn |

50% |

100.0% |

|

George Walker |

50% |

125.0% |

|

Kash Pandya |

50% |

100.0% |

|

Bill Caplan |

50% |

100.0% |

Long-term Incentive Programme

The purpose of the Long-term Incentive Programme (LTIP) is to align the interests of shareholders and management in growing the value of the business over the long-term. It does this by granting shares which vest depending on the extent to which the business meets earnings and return on capital targets over a three-year period; the value of the incentive to an executive is also heavily dependent on the level of share-price appreciation over the period, which also helps to align the interest of executive and shareholder. A useful extra feature of the LTIP is that it works as an extremely effective retention tool; the more successful the Company is (and therefore the more attractive our executives are to other companies), the more difficult it becomes for them to lure our people away. The LTIP was first introduced in 2004, and each year senior executives are invited to join. It consists of two distinct elements: the Performance Share Plan (PSP) and the Co-investment Plan (CIP). In 2010 114 individuals – about 3% of employees – were invited to join one or both of the Plans. In the last five years 219 people have been invited to the LTIP, of whom 180 are at the date of this report still employed by the Company. There have been very few voluntary leavers from amongst the population who are members of the LTIP, which is testimony to its power as a retention tool.

The CIP and PSP are both measured against the performance over three financial years and they share the performance criteria. These are the real (i.e. inflation-adjusted) compound annual growth rate over the performance period of Diluted Earnings per Share (D-EPS), and Return on Capital Employed (ROCE). This directly aligns both elements of the LTIP with group strategy and measures that the Board believes are Key Performance Indicators.

The PSP is a nil-cost conditional award of shares, some, all, or none of which vest depending on performance against the targets; the number of shares conditionally awarded is related to the salary of the individual concerned and his or her level within the Company. Since its inception, the largest PSP award has been equivalent to 100% of the recipient's salary, although the rules of the scheme permit higher levels.

The CIP is a co-investment plan, whose purpose it is to encourage executives to buy and hold shares in the Company. Executives can subscribe Aggreko shares up to a maximum value of 30% of their salary each year they are invited to join the CIP; if they hold those shares for three years, they will be entitled to receive a minimum award of one share for every two they subscribed, plus a maximum performance-related award of a further three shares for every two they subscribed.

The performance criteria for the LTIP are set annually; in 2010 they were:

- 75% of the award would be measured against the real (i.e. inflation-adjusted) compound annual growth in D-EPS over the three-year performance measurement period in a range of 3% to 10%. No performance shares would be awarded against this element if performance were less than 3% and awards would increase straight-line to the maximum at 10% growth.

- 25% of the award would be measured against the average ROCE over the performance period in a range of 25% to 27%. No performance shares would be awarded against this element if performance were less than 25% and awards will increase straight-line to the maximum at 27% ROCE.

In addition to the above, and to reward truly exceptional performance, the number of shares awarded to participants in the LTIP may be increased by between 1.3 and 2.0 times if the real compound annual growth in D-EPS over the three-year performance measurement period is in a range of 13% to 20%.

In 2010, Rupert Soames, the Chief Executive, subscribed the maximum number of CIP shares, equivalent to 30% of his salary. He was awarded PSP shares to a value at the date of grant equivalent to 100% of his salary. The other Executive Directors each received PSP awards equivalent to 70% of their salary; Messrs Pandya, Walker and Cockburn subscribed shares equivalent to 30% of their salary to the CIP, and Bill Caplan subscribed shares equivalent to 25% of his salary.

The Committee regularly reviews the LTIP design to ensure that it continues to be effective, and during the year approved some minor amendments to facilitate the administration of the Plans and to reflect current US Inland Revenue Service practice. It also agreed to offer affected participants the option of bringing forward the vesting date for 2007 awards from 19 April to 23 March 2010 in order to reflect changes in UK tax rates.

Sharesave Plans

The Board believes that Sharesave schemes are valuable in aligning the interests of employees and shareholders, and the Company seeks to make it possible for as many employees as practicable to join the scheme or its various proxies. The Aggreko Sharesave Plans are normally offered annually to employees and Executive Directors who have at least three months' continuous service, and allow a maximum of £250 per month to be saved and converted into Aggreko shares at the end of either two, three, four or five year periods, depending upon local legislation.

During the year the Board approved some minor amendments to the Sharesave Plans.

Remuneration of Chairman and Non-executive Directors

The Board, within the limits set out in the Articles of Association, determines the remuneration policy and level of fees for the Non-executive Directors. The Remuneration Committee recommends remuneration policy and level of fees for the Chairman to the Board. Remuneration comprises an annual fee for acting as a Chairman or Non-executive Director of the Company. Additional fees are paid to Non-executive Directors in respect of service as Chairman of the Audit and Remuneration Committees and as Senior Independent Director. When setting these fees, reference is made to information provided by a number of remuneration surveys, the extent of the duties performed, and the size of the Company. The Chairman and Non-executive Directors are not eligible for bonuses, retirement benefits or to participate in any share scheme operated by the Company.

Review of past performance

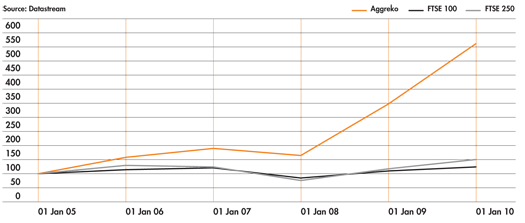

The following chart shows at the value as at 31 December 2010 of £100 invested in the Company on 31 December 2005 compared with the value of £100 invested in the FTSE 100 and the FTSE Mid 250 over the same period. The other points plotted are the values at the intervening financial year-ends. We have chosen to show performance against both indices to reflect the fact that the Company was a member of the FTSE Mid 250 during the first four years of the period and a member of the FTSE 100 during the final year. We believe general indices are more appropriate than sector and peer group comparators given the unique nature of the Company's business.

The following tables provide details of the emoluments, pension entitlements and share interests of the Directors. This information is audited.

Emoluments

The emoluments (excluding pension contributions) of Directors during the year and during 2009 were as follows:

|

2010 Emoluments |

|||||||

|

Note |

Salary |

Fees |

Benefits in kind |

Annual bonus |

Other pay |

2010 total |

|

|

Chairman: |

|||||||

|

Philip Rogerson |

– |

172,500 |

– |

– |

– |

172,500 |

|

|

Executives: |

|||||||

|

Rupert Soames |

550,000 |

– |

12,453 |

750,000 |

– |

1,312,453 |

|

|

Angus Cockburn |

330,000 |

– |

16,593 |

360,000 |

– |

706,593 |

|

|

George Walker |

1 |

302,156 |

– |

10,481 |

363,992 |

– |

676,629 |

|

Kash Pandya |

298,500 |

– |

120,325 |

267,309 |

38,580 |

724,714 |

|

|

Bill Caplan |

275,000 |

– |

1,055 |

224,740 |

– |

500,795 |

|

|

Non-executives: |

|||||||

|

Nigel Northridge |

2 |

35,667 |

– |

– |

35,667 |

||

|

David Hamill |

46,000 |

– |

– |

– |

46,000 |

||

|

Robert MacLeod |

50,000 |

– |

– |

– |

50,000 |

||

|

Russell King |

46,000 |

– |

– |

– |

46,000 |

||

|

Ken Hanna |

3 |

8,905 |

– |

– |

– |

8,905 |

|

|

2010 Total |

1,755,656 |

359,072 |

160,907 |

1,966,041 |

38,580 |

4,280,256 |

|

|

2009 Emoluments |

|||||||

|

Note |

Salary |

Fees |

Benefits in kind |

Annual bonus |

Other pay |

2009 total |

|

|

Chairman: |

|||||||

|

Philip Rogerson |

– |

145,000 |

– |

– |

– |

145,000 |

|

|

Executives: |

|||||||

|

Rupert Soames |

500,000 |

– |

1,050 |

397,150 |

– |

898,200 |

|

|

Derek Shepherd |

4 |

98,286 |

– |

87,761 |

78,975 |

– |

265,022 |

|

Angus Cockburn |

300,000 |

– |

18,608 |

186,075 |

– |

504,683 |

|

|

George Walker |

293,442 |

– |

20,097 |

116,362 |

– |

429,901 |

|

|

Kash Pandya |

290,000 |

– |

117,758 |

234,936 |

37,760 |

680,454 |

|

|

Bill Caplan |

270,000 |

– |

1,050 |

83,734 |

– |

354,784 |

|

|

Non-executives: |

|||||||

|

Andrew Salvesen |

5 |

– |

14,000 |

– |

– |

– |

14,000 |

|

Nigel Northridge |

– |

52,000 |

– |

– |

– |

52,000 |

|

|

David Hamill |

– |

42,000 |

– |

– |

– |

42,000 |

|

|

Robert MacLeod |

– |

48,000 |

– |

– |

– |

48,000 |

|

|

Russell King |

6 |

– |

38,500 |

– |

– |

– |

38,500 |

|

2009 Total |

1,751,728 |

339,500 |

246,324 |

1,097,232 |

37,760 |

3,472,544 |

|

|

Note 1: This is paid in local currency and for the purposes of this table has been converted into sterling using the average year to date exchange rate of 1.5457. Note 2: 2010 Emoluments are up to date of resignation, 31 August 2010. Note 3: 2010 Emoluments are from date of appointment, 21 October 2010. Note 4: 2009 Emoluments are up to date of retirement, 29 April 2009. Note 5: 2009 Emoluments are up to date of retirement, 29 April 2009. Note 6: 2009 Emoluments are from date of appointment, 2 February 2009. |

|||||||

Benefits in kind are made up of private health care, taxable life insurance benefits, car costs and the allowances paid to Directors on expatriate secondment.

Other pay represents cash payments in lieu of Company contributions in the Group Personal Pension Plan.

Rupert Soames was the highest paid Director. His entitlements under the Pension plan and details of his potential receipt of shares under the Long-term Incentive Arrangements are disclosed separately.

Performance targets were confirmed for the 2010 annual bonus in March 2010. The Chief Executive and the Executive Director responsible for North America had a maximum bonus opportunity of 125% of basic salary and the other Executive Directors a maximum of 100%. The performance target for the Chief Executive and Finance Director was based solely on growth in D-EPS and the performance targets for Regional Executive Directors was based as to 50% on growth in D-EPS, 40% as to growth in regional trading profit and 10% based on regional ROCE. For the annual bonus, D-EPS is calculated on a constant currency basis, using exchange rates fixed at the beginning of the year, so that the bonus reflects the underlying performance of the business, and not currency movements. The budget D-EPS for 2010 was 65.96p (representing growth of 11.7%) and the level at which maximum bonus was payable was 72.56p (representing growth of 22.9%). The actual D-EPS for 2010 on a constant currency basis was 73.03p, representing growth of 23.7%, as a result of which the maximum element of the bonus attributable to D-EPS was payable.

The table below sets out the total bonus entitlement for each Director for 2010:

|

D-EPS constant currency |

Regional element |

Total |

||||||

|

Trading profit |

ROCE |

Amount payable |

||||||

|

Growth |

% salary |

Growth |

% salary |

% salary |

% salary |

|||

|

Rupert Soames |

23.7% |

125% |

– |

– |

– |

– |

125% |

£750,000 |

|

Angus Cockburn |

23.7% |

100% |

– |

– |

– |

– |

100% |

£360,000 |

|

George Walker |

23.7% |

62.5% |

30% |

46% |

25.6% |

10% |

118.5% |

$562,623 |

|

Kash Pandya |

23.7% |

50% |

20% |

27% |

48.6% |

10% |

87% |

£267,309 |

|

Bill Caplan |

23.7% |

50% |

19% |

20% |

22.2% |

10% |

80% |

£224,740 |

Details of changes in basic salary and fees are set out in the table below.

|

Note |

Currency |

Rate of annual |

Rate of annual |

Increase % |

|

|

Chairman: |

|||||

|

Philip Rogerson |

Sterling |

200,000 |

145,000 |

37.9 |

|

|

Executives: |

|||||

|

Rupert Soames |

Sterling |

600,000 |

500,000 |

20 |

|

|

Angus Cockburn |

Sterling |

360,000 |

300,000 |

20 |

|

|

George Walker |

US Dollars |

475,000 |

460,000 |

3.3 |

|

|

Kash Pandya |

Sterling |

307,000 |

290,000 |

5.9 |

|

|

Bill Caplan |

Sterling |

280,000 |

270,000 |

3.7 |

|

|

Non-executives: |

|||||

|

David Hamill |

1 |

Sterling |

52,000 |

42,000 |

23.8 |

|

Robert MacLeod |

Sterling |

52,000 |

48,000 |

8.3 |

|

|

Russell King |

2 |

Sterling |

52,000 |

42,000 |

23.8 |

|

Nigel Northridge |

Sterling |

n/a |

52,000 |

– |

|

|

Ken Hanna |

Sterling |

46,000 |

n/a |

– |

|

|

Note 1: Change in fees from date of appointment as Senior Independent Director, 1 September 2010. Note 2: Change in fees from date of appointment as Chairman of Remuneration Committee, 1 September 2010. |

|||||

Pension entitlements

Executive Directors participate in defined contribution plans that are designed to be in line with the median practice in the relevant country but Executive Directors who reside in the United Kingdom and who joined the Board before 1 April 2002 participate in a defined benefits plan.

Rupert Soames, Kash Pandya and Bill Caplan are members of the Aggreko plc Group Personal Pension Plan. Rupert Soames is entitled to a pension contribution from the Company of 25% of his basic salary and Kash Pandya and Bill Caplan are entitled to a Company contribution of 20%. Kash Pandya has chosen not to take his entire Company contribution into the Group Personal Pension Plan and takes a proportion as a cash payment, shown as Other Pay in the Emoluments table above.

George Walker is entitled to participate in the Employees' Savings Investment Retirement plan and the Supplemental Executive Retirement plan of Aggreko LLC, which are governed by the laws of the United States. These plans allow contributions by the employee and the Group to be deferred for tax.

Contributions paid by the Company under the defined contribution plans during the year are as follows:

|

Notes |

Company |

Company |

|

|

Rupert Soames |

137,500 |

125,000 |

|

|

George Walker |

1 |

99,539 |

111,271 |

|

Kash Pandya |

15,840 |

15,840 |

|

|

Bill Caplan |

55,000 |

40,500 |

|

|

Note 1: This is paid in local currency US$153,857 (2009: US$174,429) and for the purposes of this table has been converted into sterling using the average year to date exchange rate of 1.5457 (2009: 1.5676). |

|||

Angus Cockburn joined the Company before 1 April 2002 and is a member of the Aggreko plc Pension Scheme which is a funded, defined-benefit scheme approved by HM Revenue & Customs. The key elements of his benefits are:

- a normal retirement age of 60;

- for service up to 31 December 2006, a benefits accrual rate of 1/30th for each year's service (final salary is subject to the earnings cap for service to 5 April 2006);

- for service after 1 January 2007 the accrual of benefits will be on a 'career average' basis at a rate of 1/30th for each year's service;

- an employee contribution rate of 6% of Pensionable Earnings;

- and a spouse's pension on death.

The following disclosure relates to Angus Cockburn's membership of the Scheme.

|

Age |

Accrued |

Increase in |

Increase |

Transfer |

Transfer |

Director's |

Increase |

|

|

Angus Cockburn |

47 |

73,415 |

11,751 |

8,914 |

1,281,863 |

944,994 |

18,000 |

318,869 |

|

* Note: Statutory revaluation over 2009 was negative. We have made no reduction to Mr Cockburn's benefits. |

||||||||

The transfer value has been calculated in accordance with the methods and assumptions underlying the calculation of cash equivalents under the Aggreko plc Pension Scheme which are consistent with:

(i) the requirements of Chapter IV of Part IV and Chapter 11 of Part IVA of the Pension Schemes Act 1993; and

(ii) The Occupational Pension Schemes (Transfer Values) (Amendment) Regulations 2008.

The accrued pension is the amount which would be paid at the anticipated retirement date if the Director left service as at 31 December 2010, with no allowance for increases in the period between leaving service and retirement.

Angus Cockburn is also entitled to a pension of £2,162 per annum payable from age 60 from the Aggreko plc Pension Scheme resulting from benefits transferred in from the scheme of a previous employer. This benefit is not included in the above disclosure.

All Executive Directors who are members of a pension plan are provided with a lump sum death in service benefit of four times salary.

Share interests

The interests of persons who were Directors during the year in the share capital of the Company were as follows:

|

31.12.2009 |

Granted |

Vested/ |

31.12.2010 |

Option price |

Date from which |

Expiry date |

|

|

Performance Share Plan |

|||||||

|

Rupert Soames |

77,971 |

– |

77,971 |

– |

nil |

16.04.2010 |

19.10.2010 |

|

Rupert Soames |

150,572 |

– |

– |

150,572 |

nil |

23.06.2011 |

23.12.2011 |

|

Rupert Soames |

190,114 |

– |

– |

190,114 |

nil |

16.04.2012 |

16.10.2012 |

|

Rupert Soames |

– |

82,918 |

– |

82,918 |

nil |

15.04.2013 |

15.10.2013 |

|

Angus Cockburn |

36,534 |

– |

36,534 |

– |

nil |

16.04.2010 |

19.10.2010 |

|

Angus Cockburn |

65,994 |

– |

– |

65,994 |

nil |

23.06.2011 |

23.12.2011 |

|

Angus Cockburn |

79,848 |

– |

– |

79,848 |

nil |

16.04.2012 |

16.10.2012 |

|

Angus Cockburn |

– |

34,826 |

– |

34,826 |

nil |

15.04.2013 |

15.10.2013 |

|

George Walker |

30,707 |

– |

30,707 |

– |

nil |

16.04.2010 |

19.10.2010 |

|

George Walker |

52,342 |

– |

– |

52,342 |

nil |

23.06.2011 |

23.12.2011 |

|

George Walker |

81,846 |

– |

– |

81,846 |

nil |

16.04.2012 |

20.10.2012 |

|

George Walker |

– |

32,364 |

– |

32,364 |

nil |

15.04.2013 |

15.10.2013 |

|

Kash Pandya |

33,115 |

– |

33,115 |

– |

nil |

16.04.2010 |

19.10.2010 |

|

Kash Pandya |

61,280 |

– |

– |

61,280 |

nil |

23.06.2011 |

23.12.2011 |

|

Kash Pandya |

77,186 |

– |

– |

77,186 |

nil |

16.04.2012 |

19.10.2012 |

|

Kash Pandya |

– |

33,666 |

– |

33,666 |

nil |

15.04.2013 |

15.10.2013 |

|

Bill Caplan |

71,864 |

– |

– |

71,864 |

nil |

16.04.2012 |

19.10.2012 |

|

Bill Caplan |

– |

31,344 |

– |

31,344 |

nil |

15.04.2013 |

15.10.2013 |

|

Co-investment Plan |

|||||||

|

Rupert Soames |

25,992 |

– |

25,992 |

– |

nil |

19.04.2010 |

19.10.2010 |

|

Rupert Soames |

92,928 |

– |

– |

92,928 |

nil |

23.06.2011 |

23.12.2011 |

|

Rupert Soames |

134,608 |

– |

– |

134,608 |

nil |

16.04.2012 |

16.10.2012 |

|

Rupert Soames |

– |

53,240 |

– |

53,240 |

nil |

15.04.2013 |

15.10.2013 |

|

Angus Cockburn |

15,656 |

– |

15,656 |

– |

nil |

19.04.2010 |

19.10.2010 |

|

Angus Cockburn |

56,564 |

– |

– |

56,564 |

nil |

23.06.2011 |

23.12.2011 |

|

Angus Cockburn |

80,764 |

– |

– |

80,764 |

nil |

16.04.2012 |

16.10.2012 |

|

Angus Cockburn |

– |

31,944 |

– |

31,944 |

nil |

15.04.2013 |

15.10.2013 |

|

George Walker |

13,160 |

– |

13,160 |

– |

nil |

19.04.2010 |

19.10.2010 |

|

George Walker |

44,864 |

– |

– |

44,864 |

nil |

23.06.2011 |

23.12.2011 |

|

George Walker |

82,788 |

– |

– |

82,788 |

nil |

16.04.2012 |

16.10.2012 |

|

George Walker |

– |

29,684 |

– |

29,684 |

nil |

15.04.2013 |

15.10.2013 |

|

Kash Pandya |

10,642 |

– |

10,642 |

– |

nil |

19.04.2010 |

19.10.2010 |

|

Kash Pandya |

19,960 |

– |

– |

19,960 |

nil |

23.06.2011 |

23.12.2011 |

|

Kash Pandya |

78,072 |

– |

– |

78,072 |

nil |

16.04.2012 |

16.10.2012 |

|

Kash Pandya |

– |

30,880 |

– |

30,880 |

nil |

15.04.2013 |

15.10.2013 |

|

Bill Caplan |

60,000 |

– |

– |

60,000 |

nil |

16.04.2012 |

16.10.2012 |

|

Bill Caplan |

– |

22,800 |

– |

22,800 |

nil |

15.04.2013 |

15.10.2013 |

|

Sharesave Options |

|||||||

|

Rupert Soames |

1,904 |

– |

– |

1,904 |

504p |

01.01.2011 |

01.07.2011 |

|

Rupert Soames |

– |

726 |

– |

726 |

1239p |

01.01.2014 |

01.07.2014 |

|

Angus Cockburn |

2,196 |

– |

– |

2,196 |

437p |

01.01.2012 |

01.07.2012 |

|

Kash Pandya |

– |

– |

3,351 |

– |

282p |

10.11.2009 |

10.05.2010 |

|

Kash Pandya |

1,629 |

– |

– |

1,629 |

553p |

01.01.2013 |

01.07.2013 |

|

Bill Caplan |

1,641 |

– |

– |

1,641 |

553p |

01.01.2013 |

01.07.2013 |

|

US Stock Purchase Plan |

|||||||

|

George Walker |

2,611 |

– |

2,611 |

– |

320p |

29.10.2010 |

29.01.2011 |

|

George Walker |

– |

419 |

– |

419 |

US$22.52 |

01.12.2012 |

25.01.2013 |

The options under the Sharesave Option Schemes have been granted at a discount of 20% on the share price calculated over the three days prior to the date of invitation to participate, mature after three years and are normally exercisable in the six months following the maturity date. The options under the US Stock Purchase Plan have been granted at a discount of 15% on the closing share price on the date of grant, mature after two years and are normally exercisable in the three months following the maturity date.

Awards under the Performance Share and Co-investment Plans are normally made three years after the date of grant and are subject to performance conditions which are described above.

The performance criteria for the LTIP granted in April 2007 and exercisable from April 2010 were:

- 75% of the award would be measured against the real compound annual growth in D-EPS over the three-year performance measurement period in a range of 3% to 8% (with maximum vesting at an aggregate D-EPS for the period of 73.57p). No performance shares would be awarded against this element if performance were less than 3% and awards would increase straight-line to the maximum at 10% growth. The actual D-EPS over the period was 138.0p, which exceeded the upper limit of the range and accordingly all 75% of the award vested under this criterion.

- 25% of the award would be measured against the average return on capital employed over the performance period in a range of 20% to 23%. No performance shares would be awarded against this element if performance were less than 20% and awards will increase straight-line to the maximum at 23% ROCE. The actual average ROCE for the period was 28.1%, which exceeded the upper limit of the range and accordingly all 25% of the award vested under this criterion.

Accordingly LTIP awards granted in April 2007 vested in full.

Information relating to the vesting of awards and exercise of options, to the Directors is as follows:

|

Vested/ |

Date vested/ |

Option price |

Market price |

Value |

|

|

Performance Share Plan |

|||||

|

Rupert Soames |

77,971 |

23.03.2010 |

nil |

1196p |

932,533 |

|

Angus Cockburn |

36,534 |

23.03.2010 |

nil |

1196p |

436,946 |

|

George Walker |

30,707 |

19.04.2010 |

nil |

1154p |

354,358 |

|

Kash Pandya |

33,115 |

23.03.2010 |

nil |

1196p |

396,055 |

|

Co-investment Plan |

|||||

|

Rupert Soames |

25,992 |

23.03.2010 |

nil |

1196p |

310,864 |

|

Angus Cockburn |

15,656 |

23.03.2010 |

nil |

1196p |

187,245 |

|

George Walker |

13,160 |

19.04.2010 |

nil |

1154p |

151,866 |

|

Kash Pandya |

10,642 |

23.03.2010 |

nil |

1196p |

127,278 |

|

Sharesave Options |

|||||

|

Kash Pandya |

3,351 |

26.01.2010 |

282p |

893p |

20,475 |

|

US Stock Purchase Plan |

|||||

|

George Walker |

2,611 |

06.12.2010 |

320p |

1563p |

32,455 |

The aggregate gain made on these exercises was £2,950,078 of which £1,243,397 related to the gain of the highest paid Director.

The market price of the shares at 31 December 2010 was 1482 pence and the range during the year was 882 pence to 1685 pence.

Beneficial Holdings

|

31 December 2010 |

31 December 2009 |

||||

|

Note |

Beneficial |

Non-beneficial |

Beneficial |

Non-beneficial |

|

|

Philip Rogerson |

73,782 |

– |

83,782 |

– |

|

|

Rupert Soames |

300,000 |

– |

352,475 |

– |

|

|

Angus Cockburn |

116,422 |

– |

174,232 |

– |

|

|

George Walker |

69,006 |

– |

177,819 |

– |

|

|

Kash Pandya |

100,642 |

– |

103,885 |

– |

|

|

Bill Caplan |

20,700 |

– |

15,000 |

– |

|

|

Nigel Northridge |

1 |

10,000 |

– |

10,000 |

– |

|

David Hamill |

4,000 |

– |

4,000 |

– |

|

|

Robert MacLeod |

20,000 |

– |

20,000 |

– |

|

|

Russell King |

4,000 |

– |

– |

– |

|

|

Ken Hanna |

10,000 |

– |

– |

– |

|

|

Note 1: As at date of resignation, 31 August 2010. |

|||||

Rupert Soames, Angus Cockburn, George Walker, Kash Pandya and William Caplan as Directors of the Company, have an interest in the holdings of the Aggreko Employee Benefit Trust (the 'EBT') as potential beneficiaries. The EBT is a trust established to distribute shares to employees of the Company and its subsidiaries in satisfaction of awards granted under the Aggreko Performance Share Plan and the Aggreko Co-Investment Plan. At 31 December 2010, the trustees of the EBT held a total of 6,087,304 Aggreko plc ordinary shares (2009: 4,422,419) and this holding remains unchanged at the date of this report.

Since 31 December 2010 Rupert Soames has received 1,904 shares as the result of the exercise of Sharesave options. There have been no other changes in Directors' beneficial and non-beneficial interests in shares between the end of the financial year and the date of this report. No Director was interested in any shares of subsidiary undertakings at any time during the year.

Service contracts and notice periods

All of the Executive Directors have service agreements that require one year's notice of termination from the individual and one year's notice of termination from the Company. Directors have a normal retirement age of 60. On early termination, Executive Directors are entitled to basic salary and benefits for the notice period at the rate current at the date of termination, although they will be expected to mitigate their loss where appropriate.

The Directors have, or had, service contracts or letters of appointment as follows:

|

Effective date of contract |

Un-expired term as at |

Notice |

||

|

Chairman: |

||||

|

Philip Rogerson |

Letter of Appointment |

24 April 2008* |

4 months |

– |

|

Executives: |

||||

|

Rupert Soames |

Service Agreement |

1 July 2003 |

– |

1 year |

|

Angus Cockburn |

Service Agreement |

1 May 2000 |

– |

1 year |

|

George Walker |

Service Agreement |

18 January 2001 |

– |

1 year |

|

Kash Pandya |

Service Agreement |

20 June 2005 |

– |

1 year |

|

Bill Caplan |

Service Agreement |

17 November 2008 |

– |

1 year |

|

Non-executives: |

||||

|

Nigel Northridge |

Letter of Appointment |

14 February 2008* |

– |

– |

|

David Hamill |

Letter of Appointment |

1 May 2010* |

2 years and 4 months |

– |

|

Robert MacLeod |

Letter of Appointment |

10 September 2010* |

2 years and 8 months |

– |

|

Russell King |

Letter of Appointment |

2 February 2009 |

1 year and 1 month |

– |

|

Ken Hanna |

Letter of Appointment |

21 October 2010 |

2 years and 10 months |

– |

|

* Replaces an earlier contract/letter of appointment. |

||||

External appointments

Rupert Soames is a Non-executive Director of Electrocomponents plc and is permitted to retain earnings from this position; these earnings amounted to £52,500 for the year ended 31 December 2010 (2009: £47,500). Angus Cockburn is a Non-executive Director of Howden Joinery Group plc (formerly Galiform Plc). He is permitted to retain his earnings from that position and these earnings amounted to £48,000 for the year ended 31 December 2010 (2009: £48,000).

Retention of shares by Executive Directors

The Committee has adopted a policy that encourages Executive Directors to use the Long-term Incentive Programme to acquire and retain a material number of shares in the Company with the objective of aligning their long-term interests with those of other shareholders. Under this policy, on vesting of share grants, Executive Directors, who are not within five years of their normal retirement age, should hold at least 50% of the net proceeds in shares until their aggregate holding is equivalent to at least 100% of their salary.

Russell King

Chairman, Remuneration Committee

10 March 2011