Our Strategy

Group strategy

The objective of our strategy is to deliver long-term value to shareholders, excellent service to customers and rewarding careers to our employees by being the leading global provider of temporary power and temperature control. Our strategy is founded on the belief that in our market sector, it is possible to create competitive advantage by building a truly global business – i.e. one which operates the same way around the world and can use the same fleet everywhere, the same processes, the same skills, and the same infrastructure. This homogeneity means that significant operating advantages and efficiencies accrue to those who have global scale; the focus of our efforts, therefore is directed towards building global scale and securing these advantages and efficiencies for ourselves.

The strategy was developed following an in-depth review of Aggreko's business in 2003, and has been consistently applied for the last seven years; it continues to be the basis of our business planning, and we believe that consistency of purpose has been a major contributor to our success. 20% compound growth in revenues and 33% compound growth in trading profit over the last seven years indicate that the strategy is the right one, and we continue to work relentlessly to implement it.

|

Aggreko Group – excluding pass-through fuel |

|||

|

2010 |

2003 |

CAGR |

|

|

Revenue (£m) |

1,156 |

324 |

20% |

|

Trading profit (£m) |

310 |

42 |

33% |

|

Trading margin |

27% |

13% |

|

|

Diluted earnings per share (pence) |

78.98 |

10.14 |

34% |

|

Return on capital employed (ROCE)* |

32% |

13% |

|

|

Enterprise value at year end (£m)1 |

4,198 |

514 |

35% |

|

* calculated by dividing operating profit for a period by the average net operating assets as at 1 January, 30 June and 31 December. 1 Enterprise value is defined as market value plus net debt. |

|||

The strong growth over recent years was only made possible because, over the preceding 40 years, Aggreko's management and owners had patiently built a foundation of service centres in North America, Europe, the Middle East, Asia and Australia; had spotted that designing and building our own equipment had major advantages; had created a hard-working, entrepreneurial and customer-focused culture; and had built a brand. The lesson we see every day is that it takes decades to achieve the sort of global scale Aggreko now has, and there are no short cuts.

Aggreko's strategy is developed by the senior management team, led by the Chief Executive, and involves internal and external research, much of it proprietary. We seek to develop a deep understanding of the drivers of demand, changing customer requirements, the competitive environment, as well as developments in technology and regulation. We look at our own strengths and weaknesses, and at the opportunities and threats that are likely to face us. From this analysis, we develop a list of investment and operational options, and analyse their relative risks and rewards, bearing in mind the capabilities and resources of the Group.

We regularly test our strategy which keeps it fresh and relevant, and enables us to spot and react to new opportunities. Having conducted a root-and-branch review in 2003 we re-examined our conclusions in 2005, 2007 and 2009. The conclusions from the 2009 review, which were communicated to investors in March 2010, are summarised below:

- The strategy we developed in 2003, and re-affirmed in 2005 and 2007, is working well.

- Our Local business continues to offer attractive opportunities for growth, both from growing our density and footprint in existing markets, and expanding into new countries.

- The factors which have driven the growth of our International Power Projects business will continue to provide plenty of headroom for this business for the foreseeable future; the world faces serious structural shortages of power which will last for many years and which should sustain demand for our services.

- In our 2009 review we stepped up the work we are doing on emissions and planning the transition of our fleet to use equipment with improved emissions performance.

- In all our businesses, there are opportunities to improve the efficiency of operations, whilst maintaining our prized agility. There are plenty of things we can do better.

We plan to start the next review of our strategy in 2012; our next formal strategy update to investors is likely to be in early 2013.

Our strategy for each of the business lines is set out below and, at the end of this section, we reflect on some of the future trends that we believe may come to be important to our business in the years ahead.

Business line operational strategy

Supporting the Group strategy, Aggreko has developed operational strategies for our two different lines of business:

- The Local business rents power and temperature control systems, from small generators to large cooling plants, to customers who are typically within a few hours' driving time of our service centres;

- The International Power Projects business builds and then operates temporary power plants, selling their capacity and output to utilities, the military and major mining and oil companies.

The Local business

The Local business serves customers from 148 service centres in 34 countries in North, Central & South America, Europe, the Middle East, Africa, Asia and Australasia. This is a business with high transaction volumes: average contracts (excluding major events) have a value of around £10,000 and last a few weeks. The Local business represents 60% of Aggreko's revenues, excluding pass-through fuel, and 46% of trading profit. Since our first strategy review in 2003, revenues and trading profit have increased at a compound growth rate of 15% and 27% respectively:

|

Aggreko Local business |

|||||

|

% of Group |

|||||

|

2010 |

2003 |

CAGR |

2010 |

2003 |

|

|

Revenue (£m) |

696 |

258 |

15% |

60% |

80% |

|

Trading profit (£m) |

142 |

27 |

27% |

46% |

64% |

|

Trading margin |

20% |

10% |

|||

|

ROCE* |

26% |

11% |

|||

There are three elements in our strategy for the Local business:

- Maintain a clear differentiation between our offering and that of our competitors through superior service.

- Use the benefits of global scale to be extremely efficient. This should enable us to make attractive returns whilst delivering a superior service at competitive prices.

- Offering superior service at competitive prices will allow us to increase market share and extend our global reach, delivering growing revenues at attractive margins.

Against the first objective – to maintain a clear differentiation between our offering and that of our competitors – third-party research shows that Aggreko is one of the world's best-performing companies in terms of customer satisfaction. We are determined to maintain this reputation for premium service and we do this through the attitude and expertise of our staff, the geographic reach of our operations, the design, availability and reliability of our equipment, and the ability to respond to our customers 24 hours a day, 7 days a week.

The claim to be one of the world's best-performing companies in terms of customer satisfaction is a big one, but we think we have good reason to make it. For each of the last 5 years we have been asking about 25,000 customers what they think of the service they have received from us, and measure our Net Promoter Scores. This is an objective measure of customer satisfaction which reflects the balance between those who think we are wonderful, and those who think we are dreadful. Happily, the former greatly outnumber the latter. Over the last 5 years our score has improved by 10pp and Satmetrix, a global leader in customer experience programmes who manage over 11 million customer responses annually (including Aggreko's), have confirmed that our Net Promoter Score in 2010 was the highest of all their customers benchmarked world-wide in the business-to-business segment.

The second objective of our strategy for the Local business is to be extremely efficient in the way we run our operations. This is essential if we are to provide superior customer service at a competitive price and, at the same time, deliver to our shareholders an attractive return on capital. In a business in which lead-times are short, logistics are complex, and we process a large number of low-value transactions, a pre-condition of efficiency is having high quality systems and robust processes.

The operation of our Local businesses in most areas is based on a 'hub-and-spoke' model which has two types of service centre: hubs hold our larger items of equipment as well as providing service and repair facilities; spokes are smaller and act as logistics points from which equipment can be delivered quickly to a customer's site. The hubs and spokes have been organised into areas in which a manager has responsibility for the revenues, profitability and the return on capital employed within that area. In this model, most administrative and call handling functions are carried out in central rental centres.

Our Local business enjoys numerous advantages as a result of its global scale. Standardised operating processes, and the investment in a single global IT platform, bring visibility and homogeneity. Global utilisation statistics allow us to spot where equipment is under-utilised, and where it can be moved to for the best return, and this is reflected in the increase in revenue to average gross rental assets, which is a financial measure of utilisation; between 2004 and 2010, revenue to average gross rental assets in the Local business increased from 62% to 82%. Global fleet sourcing allows us to stock our fleet with premium-quality equipment at competitive cost. Global reach allows us to deliver service to customers (such as major events customers) wherever they go. Global processes allow us to disseminate best practice quickly. The benefits of our global scale accrue to both customers and shareholders. Our Net Promoter Scores tell us that the model works well for customers and, for our shareholders the benefit has been a compound growth in trading profit of 27% over the last 7 years and a return on capital employed that has improved from 11% to 26% over the same period.

The third objective of our strategy for the Local business is to deliver growth in revenues by increasing market share and global reach. In our more mature markets, such as North America and Europe, we know that the most profitable businesses are those where we have dense networks of service centres which can share equipment, staff and customers, and benefit from the low transport costs that come from being physically close to customers. So, in these markets, we focus on adding new service centres and upgrading existing centres to make them more capable. In the last 4 years, in our mature markets in Australia, North America and Europe, we have opened or upgraded service centres in:

North America: Indianapolis, Long Island, Fort McMurray, Gillette, Shreveport, Minneapolis St Paul, Seattle, Ft St John, Minot, Roosevelt

Europe: Bordeaux, Bristol, Metz, Padova, Berlin

Australia: Geraldton, Gladstone

However, we know that our businesses grow fastest where there is strong growth in GDP, and, specifically, in Aggreko GDP (GDP weighted to industries which typically use our services). So a core part of our strategy has been expanding our Local business in the faster-growing economies of South America, the Middle East, Africa and Asia. The acquisition of GE Energy Rentals in 2006 helped us to expand our footprint in Brazil, Chile and Mexico and, since then, we have opened or upgraded service centres in:

Africa: Johannesburg

Middle East: Doha, Jebel Ali, Abu Dhabi, Muscat, Jeddah, Al Khobar

Central & South America: Panama, Buenos Aires, Antofagasta, Recife, Parauapebas, Concepcion, Monterrey, Villahermosa

Asia: Pune, Shanghai, Dalian, Singapore

Russia: Moscow

International Power Projects

This business serves the requirements of power utilities, governments, armed forces and major industrial users for utility-quality, temporary power generation. Whereas in the Local business we rent equipment to customers who operate it for themselves, in International Power Projects we contract to provide power generated by plants financed, built, commissioned and operated by our own staff. The power plants can range in size from 10 megawatts (MW) to 200MW on a single site.

The business operates in areas where we do not have a large Local business. Most of the customers are power utilities in Africa, Asia, Central and South America. As described in the 'What we do' section, the driver of demand in these markets is that our customers' economies are growing, with consequent increases in demand for additional power which cannot be met by the current generating capacity. As a result, many of them face chronic power shortages which damage their ability to support economic growth and increased prosperity. These shortages are often caused or exacerbated by the variability of supply arising from the use of hydro-electric power plants whose output is dependent on rainfall. We estimate that the gap between world-wide supply and demand of electricity is growing by some 50,000MW per annum, which compares to our International Power Projects fleet size of around 3,600MW.

International Power Projects now represents 40% of Group revenues and 54% of trading profit, excluding pass-through fuel. Since 2003, International Power Projects revenue excluding pass-through fuel and trading profit have grown at a compound annual growth rate of 32% and 41% respectively:

|

International Power Projects excl pass-through fuel |

|||||

|

% of Group |

|||||

|

2010 |

2003 |

CAGR |

2010 |

2003 |

|

|

Revenue (£m) |

460 |

66 |

32% |

40% |

20% |

|

Trading profit (£m) |

168 |

15 |

41% |

54% |

36% |

|

Trading margin |

37% |

23% |

|||

|

ROCE* |

40% |

25% |

|||

|

Note: pass-through fuel refers to revenues we generate from one customer for whom we have agreed to manage the provision of fuel on a 'pass-through' basis. This revenue stream fluctuates with the cost of fuel and the volumes taken, while having an immaterial impact on our profitability. We therefore exclude pass-through fuel from most discussions of our business. |

|||||

The strategy for this business is straightforward: grow as fast as we prudently can, to secure for ourselves the operating efficiencies and competitive advantages which come from being the largest global operator. So far, we have been successful in executing this strategy, and our International Power Projects business is now many times larger than its next largest competitor.

The reason why it is advantageous to be a global operator in International Power Projects is because demand can shift rapidly between continents. In 2003, South America and Asia were probably the largest markets, and Africa was only a small proportion of global demand. In 2009, the market in Africa was larger than South America and Asia combined. Going in to 2011, the position (as measured by our fleet-on-rent) is reversed, with about 500MW having come off-hire in Africa in 2010 and about 700MW going on-hire in Asia. These shifts in demand were driven in part by rainfall patterns, in part by the relationship between economic growth and investment in permanent power generation and in part by geo-political issues. To be successful in the long-term, therefore, requires the ability to serve demand globally, and that requires sales, marketing and operational infrastructure to be present in all major markets.

The reason we want to be big – and bigger than any of our competitors – is because we believe that, as in the Local business, scale brings significant competitive advantages in International Power Projects. There are numerous reasons for this:

- Being able to address demand on a world-wide basis means higher utilisation. When fleet returns from a customer at the end of a contract, the speed with which it can be put back on contract again is a major determinant of profitability and returns on capital. Fleet will find new work far more quickly if it can address the total pool of world demand than if it is only able to operate in a single region.

- By the time customers have decided they really do have to spend money on temporary power, they generally want it as fast as possible. Being able to offer very fast lead-times for large amounts of capacity is a significant competitive advantage. Small operators simply cannot afford to keep 250-300MW of capacity (say, £30-£40 million of capital) sitting idle waiting for the next job. Because the equipment used in International Power Projects is also used in the Local business fleet, we manage our large generators as a common global pool. Between the Local business and International Power Projects, we currently have a fleet of over 5,000 of these large generators, and can deploy hundreds of MW of capacity from our various businesses around the world on very short notice. A good example would be a recent power contract in Bangladesh, where we were able to deliver and commission 200MW spread over 3 sites within 90 days of the contract signature; no competitor could deliver so much power in such a short lead-time, and a permanent power plant of similar scale would take years to deliver and install.

- The management of risk is a critical part of our business; we place tens of millions of pounds worth of capital assets in countries where the operational, political and payment risks are high – sometimes very high. While we take great care to mitigate these risks, it is probable that sooner or later we will have a loss of either receivables, or equipment, or both. However, because of our scale, such a loss would not imperil the company as a whole. We treat our risks in the same way investors do: we minimise the risk of losses doing material damage to the business by having a broad portfolio of exposures, none of them correlated. For smaller companies, their portfolio of country risk is inevitably much more concentrated; the probability of loss in any one country for smaller companies is no less than it is for us, but their ability to withstand the consequences of a large loss is. Scale therefore allows us to deal in markets where others might, with good reason, fear to tread.

- Returns from rental businesses are heavily dependent upon the underlying capital cost of the rental fleet. Clearly, large buyers should get better terms than small buyers and, since we are by far the largest purchaser of power generation for rental applications in the world, we believe that we are advantaged in this area. The fact that we have the scale to justify having our own manufacturing and design facilities also means that we can source equipment better suited to our precise requirements, and more cheaply, than smaller operators.

In summary, a large operator will have lower volatility of demand, better lifetime utilisation of equipment, be better able to respond to customer requirements, and will have a lower capital cost per MW of fleet. In International Power Projects, bigger is better – and Aggreko is now much larger than any other competitor in this market, as well as being the only company to have distribution in all the major markets.

Further ahead

In our 2009 Annual Report, we set out thoughts about opportunities that might arise from the de-carbonisation of power generation in developed countries. In 2010 we have continued with our research in this area, and we remain hopeful that there will be money-making opportunities, but they will take years, rather than months, to develop. When they come, however, they could be material, so we are continuing to work on building our expertise in this sector. Because this is important work in progress, we repeat below what we said in last year's Annual Report, suitably updated.

In the 2009 strategy update, presented to investors in March 2010, we tried to look ahead and outside the boundaries of our existing business model to see if there might be other opportunities for us to deliver value to our shareholders. We were encouraged by what we found, and we set out below some of our thoughts about the way the energy market might develop.

We estimate that world demand for electricity will increase at a compound rate of around 4% between 2007 and 2015; this compares to a growth in net capacity of around 3% per annum, resulting in a world-wide projected shortfall in supply growing at around 50,000MW per annum. This supply:demand gap is likely to be focussed on emerging markets, who have burgeoning demand, and inadequate supply. These emerging markets have been strong markets for our International Power Projects business for the last five years. In our 2009 study however, we identified that some of the stresses which create demand for us in emerging markets may also start to appear in more developed economies.

The market for the supply of electricity, like most utility businesses, thrives on stability and hates uncertainty. This is particularly so in countries that rely on the private sector to fund investment in power generation, which is the case in most developed markets. The long life and enormous capital costs of the infrastructure required to generate and deliver cheap electricity require an environment in which investors can build power plants and be reasonably sure of the amount of money they will earn over the next thirty or forty years. We believe that the market for the supply of electricity in developed countries is going through a phase where that stability and certainty is lacking. There is going to be a lot of change, uncertainty and market stress, and the next 10 years are going to be hugely challenging for governments, regulators, investors and operators.

The main source of that stress and uncertainty arises from the struggle to devise ways to manage the electricity supply market to deliver de-carbonisation of power generation, and to accommodate changing public attitudes to nuclear power. On the one hand, over the last 50 years the great power-plant manufacturers of the world have developed extremely effective technology for generating vast amounts of cheap electricity using hydro-carbon and nuclear fuels. These technologies have been perfected in time for public opinion to decide that they must have less of that and far more renewable technology, much of which is decades away from competing in terms of either cost or efficiency with thermal plants.

The amount of subsidy, or the increase in the price of carbon, required to level the playing field between a modern Combined-Cycle Gas Turbine and an offshore wind-farm is enormous. Regulators, economists and politicians have struggled to devise 'market signals' with which they can square this circle, proposing revisions to policy, subsidy regimes and planning regulations at bewildering rates, and this rapidly changing outlook has encouraged investors to wait-and-see rather than build new plant.

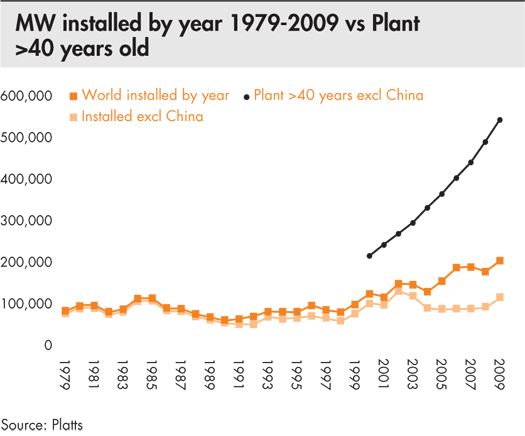

Levels of investment have been inadequate to replace power plants which, either because of age or because they fail to meet emissions standards, will have to be closed in the next 10 years. Between 2000 and 2009 the amount of generating capacity outside China over 40 years old (a reasonable proxy for the average life of power plants) more than doubled, and yet in the same period the amount of new capacity commissioned per year outside China fell (see graph); by 2015 over a quarter of the world's generating capacity outside China will be over 40 years old. These trends are shown in the graph below; the red line shows the dramatic growth in the amount of generating capacity over 40 years old.

We believe that the developed world is building up a bow-wave of delayed investment that sometime in the next 10 years will have to break. The most immediate effect of the wave breaking will likely be rapid inflation in the building costs of new plant as plant operators rush to order the plants that should already be in construction.

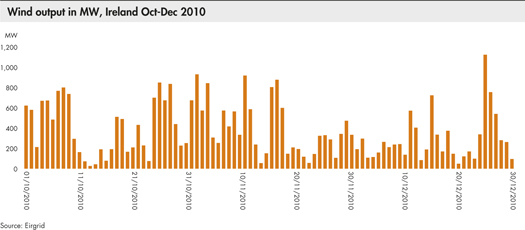

But what plants will they build? The majority of plants will inevitably have to be thermal, but the electricity networks of the future are all going to have to deal with large amounts of wind-power, and that is going to require substantial investment in transmission and distribution networks to cope with intermittent output and, in the case of wind, the fact that large wind-farms have to be positioned far from centres of consumption. For those unfamiliar with the variability of wind generation, the graph below shows the output from Ireland's 900MW of installed wind capacity during the period 1st October-31st December 2010.

During this 3-month period, there were 21 occasions where power output varied by more than 100MW within 15 minutes; 108 when that variation occurred within 30 minutes. The peak output was over 1,130MW, and the lowest was 24MW. These variations in output bore no relationship to demand.

Presenting these facts is neither a polemic against wind-power, nor one in favour of thermal plants. It is simply stating that the generation mix in 10 years time will be different and will have to cater for part of the mix being far more variable than system operators are used to having to deal with.

Our whole strategy in developing our International Power Projects business has been based on our analysis that the energy gap between supply and demand was getting worse, and particularly so in emerging markets. So that is not new. What is new is our analysis that similar stresses may begin to emerge in developed economies over the next 10 years, driven partially by the policy of de-carbonising power generation and lack of investment.

These stresses should present opportunities for Aggreko. The technology which we have developed over recent years has some unique features that may make it attractive to system operators who will have to manage large amounts of renewable generation, low reserve margins and ageing plant. To be more specific:

- We have developed a highly-efficient, multi-fuel, utility power generating capability which has a capital cost per megawatt about one third that of conventional utility power plants. We think conventional power-plant technologies such as Combined-Cycle Gas Turbines, Hydro and Nuclear, while ideally suited for base-load operation, will struggle with the economics of operating on an intermittent basis and the unpredictable start-stop cycle required to respond to the variable output of renewable power generation.

- Our technology is ideally suited to intermittent, fast-start operation. Within 30 seconds we can bring enough power on-line to keep the lights on for whole cities. We think system operators will come to find this sort of sustainable, distributed, fast response capability essential if they are to operate with meaningful amounts of wind generation.

- Our technology is ideally suited to distributed operation. Because it comes in 1MW blocks and is mobile, we can put 25MW here, 150MW there and 5MW over there; and then can shift 50MW of the 150MW site to the 25MW site within a couple of days. We think that distributed generation will become increasingly popular with system operators and they will value the mobility and flexibility we have the capability to provide. And, for our part, we should be able to generate premium returns by being able to move our plant globally to where the need, and therefore the price, is greatest.

- To match what we believe will become an increasingly attractive technical proposition, we also have, for a power generation company, an enormous customer base and global reach. We already are established suppliers to power utilities and governments in around 50 countries. This means that we have the ability to roll out good ideas on a global scale.

In summary: to date, the main focus of our International Power Projects business has been emerging markets. Over the next 10 years, however, as wind penetration rises, and as old plants retire, reserve margins will fall in developed economies as well. At this point, opportunities might arise for Aggreko to support system operators and utilities in developed markets as well as in emerging markets.

We would like to stress that this is not a short-term opportunity. Quite the opposite: in the short term many developed countries have high reserve margins as the economic crisis has caused power consumption to reduce. But these reserve margins are forecast to fall quite sharply between now and 2020. So we will spend some time over the next few years exploring these ideas.

Capital structure

The intention of Aggreko's strategy is to deliver long-term value to its shareholders, and so far we have been highly successful in doing so, both on an absolute and a relative basis. Since 2005 we have delivered a 458% growth in our index of Total Shareholder Return – which compares with 25% and 49% for the FTSE-100 and FTSE-250 respectively. This value creation comes from two sources. First, share price accretion as a result of 42% compound growth in earnings per share; this earnings growth is the result of very high rates of capital investment in the business, (about £1 billion invested over the last five years, compared to depreciation over the same period of about £590 million), along with one large and several small acquisitions (about £132 million spent over the last five years). The second source of investor return has been dividends which, since 2005, have grown at a compound rate of 25%.

With the business delivering returns on average capital employed of over 30%, it is clearly in our shareholders' interests that we invest as much as we prudently can into the business. However, the margins and returns are currently so strong that in the last two years we have been able to reduce levels of net debt substantially, while investing far ahead of depreciation. From a peak level of net debt of £364 million (31 December 2008) and peak Net Debt to EBITDA of 1.3 times (31 December 2006), net debt has reduced to £132 million, and Net Debt to EBITDA to 0.3 times as at 31 December 2010. Given the proven ability of the business to fund organic growth from operating cashflows, and the nature of our business model, it seems sensible to run the business with a modest amount of debt. We say 'modest' because we are strongly of the view that it is unwise to run a business which has high levels of operational gearing with high levels of financial gearing.

Since the Group demerged in 1997, Net Debt to EBITDA has averaged around 1 times, and this is a level we feel is about right for our business. Absent a major acquisition, or the requirement for an unusual level of fleet investment, it gives us the ability to deal with the normal fluctuations in capital expenditure (which can be quite sharp: +/- £100 million in a year) and working capital, and is well within our covenants to lenders which stand at 3 times. We have concluded therefore that, over the medium term, we should aim to keep our net debt at 'around' 1 times.

In terms of the pace at which we move to the 1 times level, we think that the need for flexibility argues for moving over the next 2 to 3 years rather than in a single step. It is with this in mind that we have announced our intention to effect a return of value of approximately £150 million in 2011 (to be effected by way of a B share scheme), and a further amount, depending on circumstances in the next 2 to 3 years, that will move Net Debt to EBITDA to around 1 times.