Business Review

Electrocomponents plc is the leading high service distributor to engineers worldwide

NATURE OF THE BUSINESS

Electrocomponents plc is the leading high service distributor to engineers worldwide. The Group operates in 27 countries and sells to most of the remaining countries of the world via third party distributors.

The Group satisfies the small quantity product needs of its customers who are typically research and development (‘R&D’) or maintenance engineers in business. A large number of high quality goods are stocked, which are dispatched the same day that the order is received. The average customer order value is generally less than £100 although the range of order values is wide. The Group has a large number of customers, around 1.6m, from a wide range of industry sectors with diverse product demands. This means that the Group manages tens of thousands of orders for customers across the World each working day.

STRATEGY

We have made good progress implementing our strategy with the focus on R&D and Maintenance engineers supporting the Group’s growth.

The Group now has a strong platform for growth comprising leading positions in growing markets, world class global infrastructure, strong customer propositions and a profitable UK business. Following a review of the Group’s strategy the Board has identified further key areas of focus with which to drive future performance. These are explained and discussed in more detail in the Chief Executive’s Review.

STRENGTHS AND RESOURCES

Brands

The Group has a number of major brands. The most significant of these is ‘RS’ which is used all over the World, except in North America, France and Ireland where the ‘Allied’, ‘Radiospares’ and ‘Radionics’ brands are used respectively.

Geographic footprint

Our operating companies provide our high service level across countries, representing around 80% of the world’s GDP. The Group’s Distributors serve Eastern European, Russia, Southern Europe, the Middle East and South America and represent a further 10% of the world’s GDP.

Customer relationships

We supply around 1.6m customers from a wide range of industrial sectors. We have relationships with both the end users who utilise our products and also with the companies for whom they work. Our customers are typically R&D and maintenance engineers.

Supplier relationships

The relationships with our suppliers are an important element in allowing us to maintain high standards of product availability for our customers. We purchase some 450,000 products from around 2,500 major suppliers throughout the World with increasing focus on global purchasing agreements. Our offer to R&D engineers is valuable to many of our suppliers, who would otherwise find the small order and immediate dispatch requirements of such customers difficult and costly to satisfy. Our relationships with our suppliers have developed further with an increasing number of successful joint customer facing promotions across many of our businesses.

e-Commerce

e-Commerce provides the Group with the ability to reach an increasingly broad customer base. e-Commerce is also enabling us to extend our on-line product offer. We now have the ability to launch new products on a daily basis and have implemented a new guided navigation search capability to ensure customers are able to find the exact product to meet their needs. We are also increasingly utilising on-line merchandising as a tool to highlight to customers relevant products and information which is offering improved customer experience and revenue opportunities.

Employees

The skills and support from our employees is extremely important to the Group. During the year we employed around 5,700 employees worldwide. The geographic spread of our employees is: 1,800 in the UK, 1,300 in Continental Europe, 800 in North America, 1,000 in Asia Pacific and 800 in the Groupwide Processes.

As in previous years the number of our employees who are focussed on sales and marketing activities has increased.

Infrastructure

The Group recognises that the provision of a high service level is extremely important to our customers. Accordingly, over the last five years, we have invested in further improving the Group’s infrastructure. Two particular areas stand out:

Since May 2007 all of our businesses in Europe together with our UK business have operated on a single integrated regional system. Likewise, our Asian business now operates from a separate integrated system which was completed during 2008.

Operating on these robust and integrated platforms enables us to drive sales, improve efficiency, share best practice and reduce our risk profile.

As our businesses grow we continue to invest in larger warehouses. Most recently we have moved into a new warehouse and office facility in Allied, our North American business. This was in response to the more than doubling of the business's volumes over the last 5 years. This investment will support the business and its projected growth for the next 5 years.

Operating Performance & KPIs

Revenue growth

5%

Operating performance

| 2008 | 2007 (restated)(5) |

|

|---|---|---|

| Revenue | £924.8m | £877.5m |

| Gross margin | 50.2% | 50.5% |

| Contribution | £203.2m | £194.2m |

| Group Process costs | (£85.1m) | (£82.9m) |

| EBS costs | (£14.4m) | (£19.0m) |

| Headline operating profit | £103.7m | £92.3m |

| Interest (net) | (£7.3m) | (£5.9m) |

| Headline profit before tax | £96.4m | £86.4m |

| Headline earnings per share | 14.8p | 13.1p |

| Dividend per share | 18.4p | 18.4p |

Key performance indicators

| 2008 | 2007 (restated)(5) |

|

|---|---|---|

| Group revenue growth | 5.4% | 9.0% |

| International | 8.4% | 14.5% |

| UK | 0.9% | 1.9% |

| e-Commerce revenue share | 31% | 28% |

| Headline Group return on sales(1) | 11.2% | 10.5% |

| Headline EBITDA(2) | £130.9m | £120.2m |

| Free cash flow | £75.0m | £45.3m |

| Headline ROCE(3) | 24.0% | 21.2% |

| Stock turn (per year) | 2.9x | 2.7x |

| Revenue per head (£’000)(4) | 162 | 161 |

| Number of customers (millions) | 1.6 | 1.5 |

- (1)

- Headline operating profit expressed as a percentage of revenue

- (2)

- Headline earnings before interest, tax, depreciation and amortisation

- (3)

- Headline operating profit expressed as a percentage of net assets plus net debt

- (4)

- Revenue on a like for like basis (2007 and 2008) adjusting for trading days and foreign exchange

- (5)

- Catalogue costs: In light of proposed amendments to IAS 38, Intangible Assets, the Group’s Directors have decided to make a voluntary change to the policy to write off catalogue production and print costs as they are incurred. This means that the 2007 results and balance sheet are restated, further detail is provided in note 27 to the Group accounts

Business Performance

Headline profit before tax up

12%

Headline profit before tax has increased by £10.0m (11.6%). The main contributors to this performance were growth of our International (£5.7m) and UK (£3.3m) businesses and reducing EBS costs (£4.6m). Partially offsetting these improvements, Process costs and interest costs increased by £2.2m and £1.4m respectively.

At constant foreign exchange rates (principally adjusting for the strengthening Euro), the headline profit before tax has increased by 10.7%.

Our International Business has increased its contribution principally due to continued strong sales growth. The UK Business’s contribution improved as sales grew for the second successive year and strong operating leverage reduced operating costs by nearly 1% point as a percentage of revenue.

Process costs, as a percentage of revenue, reduced by 0.2% points, again demonstrating the cost leverage capability of the business.

EBS costs were reduced with the completion of the implementations in Europe and Asia Pacific early in the financial year.

e-Commerce

e-Commerce is a key enabler for many of our initiatives. It allows the Group to make a very wide range of products available globally at lower cost. During the year, the UK, European and International Distributor network websites were replaced with significantly updated and improved new sites. These have provided immediate benefits for our customers including:

- an improved intuitive search and browse solution;

- the provision of information on local product availability and pricing;

- the capability to introduce new products and information on a daily basis.

Customer reaction has been positive. The equivalent new sites were successfully launched across our Asia Pacific business in April.

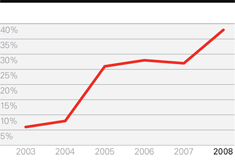

e-Commerce revenue growth has been strong at 16%. From its start in the UK in 1998, this highly effective and customer oriented channel has now grown to nearly a third of the Group’s revenue for the year, with an exit rate of 33% in March. This includes a 64% revenue share in Japan, 37% in the UK and 35% across Europe.

Back to topGross Margin

All the Group’s regions have recorded increased gross profit. Group gross profit was up from £443.5m last year, to £464.7m this year.

The Group’s gross margin has been stable for the last 18 months. The gross margin has benefited from the actions taken across the Group to reduce product costs including rationalisation of the maintenance range, own brand growth and extending Far East sourcing.

Operating Costs

The Group’s management continues to focus on controlling operating costs which reduced as a percentage of revenue by 1.1% points after adjusting for the North American premises move.

During the year, further actions have been undertaken to realise some £2.6m of annualised cost reductions. These actions have been applied across many areas of the business and included headcount, logistics, and catalogue cost savings with the associated reorganisation costs totalling £1.0m.

Cumulative cost savings now stand at £10.2m: exceeding the £10m annualised target set in May 2005.

Cash Flow and Net Debt

Free cash flow £75m

66% increase

The Group’s free cash flow improved significantly during the year, up to £75.0m. This is a £29.7m improvement on the previous financial year. This was due to higher profits together with other significant activities during the year. These activities included the delivery of EBS benefits which provided improved stock management in Europe and the UK and resulted in increased stock turn. In addition, capital expenditure on EBS and the North American warehouse were lower this year.

Net debt was £151.1m at 31 March 2008, £14.9m higher than last year with interest cover remaining high at 14x. Net debt to EBITDA was 1.2x. The pension deficit (net of deferred tax) fell by £5.2m to £23.9m.

Back to topInternational

| 2008 | 2007 (restated) |

|

|---|---|---|

| Revenue | £566.8m | £521.3m |

| Revenue growth | 8.4% | 14.5% |

| Gross margin | 48.5% | 48.7% |

| Operating costs % of revenue | (30.5%) | (30.2%) |

| Contribution | £102.3m | £96.6m |

| % of revenue | 18.0% | 18.5% |

The International business is increasing its share of the Group, now representing over 60% of the Group’s revenues. The International business comprises Continental Europe (56% of revenue of the International business), North America (29%) and Asia Pacific (15%).

Gross margin was stable during the year. The business again demonstrated operating cost leverage with costs (after adjusting for the North American office and warehouse move) as a percentage of revenue reducing by 0.1% points from the previous year.

Continental Europe

| 2008 | 2007 (restated) |

|

|---|---|---|

| Revenue | £316.2m | £287.5m |

| Revenue growth | 5.7% | 10.1% |

| Contribution | £71.0m | £65.1m |

| % of revenue | 22.5% | 22.6% |

The Continental Europe business comprises eight separate businesses. France, Germany and Italy are the largest which in total make up about 75% of the region’s revenue. The five smaller businesses are Austria, Benelux, Ireland, Scandinavia and Spain. Our regional presence and high service levels across Europe are supported by 12 locally priced catalogues and web sites. We have, in total, 40 web sites across Europe including our distributor network. We supply our customers through seven warehouses across the continent.

The European region grew revenue by around 6%. All eight of the operating companies grew during the year with the Benelux and Spanish businesses performing particularly well, growing at over 10%.

Much of the revenue improvement derived from continued development of Group and local customer driven initiatives. Examples of these include increased new product introductions, the development and roll out of a regional strategy for better support and service to larger customers, increased joint supplier initiatives and realigned sales structures in some of the larger operating companies.

North America

| 2008 | 2007 (restated) |

|

|---|---|---|

| Revenue | £163.3m | £157.2m |

| Revenue growth | 10.4% | 21.8% |

| Contribution | £22.0m | £23.4m |

| % of revenue | 13.5% | 14.9% |

Allied, the Group’s North American business, continued to perform well, growing revenue at over 10% during the year whilst also moving to its new premises. This performance is all the more impressive since this is the fourth successive year that the business has grown revenue at double digit rates. Much of this performance has been driven by the business’s extensive local presence: with 55 local sales offices across North America.

As a result of the sustained and strong sales growth the business was close to using all of its local warehouse capacity. The Group therefore approved the construction and move to significantly larger premises. This move was successfully managed through the year and involved the transfer of over 100,000 products in an eight week window whilst still shipping over 9,000 lines a day and maintaining 90+% service levels.

The business has developed a successful growth strategy which is based upon its local branch network and joint campaigns with key suppliers. In the period additional sales heads were added and the business had a successful supplier expo in November 2007 with over 100 vendors attending.

Gross margin has declined slightly due to changing product sales mix. The underlying contribution, adjusting for the impact of the weakening of the US Dollar (£1.3m) and the one-off warehouse and office move (£1.5m), increased by £1.4m (6%).

We are continuing to evaluate the roll out of EBS in Allied.

Asia Pacific

| 2008 | 2007 (restated) |

|

|---|---|---|

| Revenue | £87.3m | £76.6m |

| Revenue growth | 15.2% | 17.3% |

| Contribution | £9.3m | £8.1m |

| % revenue | 10.6% | 10.6% |

The region’s continuing strong growth confirms our confidence in the potential of this business.

The Group now has a strong presence in Asia Pacific, operating businesses in ten countries together with a network of distributors servicing customers in other markets across the region.

The Group employs around 1,000 staff in Asia Pacific, with seven warehouses which stock in excess of 70,000 product lines with a next day offer to customers. Local language catalogues and web sites are available including Japan and China. The Chinese catalogue has a distribution in excess of 70,000. In China we employ around 400 staff with six sales offices across the country.

Within Asia Pacific, all regions have delivered revenue growth with the strongest performance being in China which has grown at over 35% as the strengthened management team have driven customer acquisition. In Japan, e-Commerce now accounts for 64% of revenue. In South Asia, the business has been successful in targeting growing sectors while in Australia major accounts have significantly contributed to growth.

In April 2008, the business’s web site offer was upgraded in line with the new offer enjoyed by customers in Europe and the UK from January 2008.

During the year, additional overhead investments were made in key markets and regional infrastructure to accelerate future growth which led to the stable market contribution as a percentage of sales.

Back to topUK

| 2008 | 2007 (restated) |

|

|---|---|---|

| Revenue | £358.0m | £356.2m |

| Revenue growth | 0.9% | 1.9% |

| Gross margin | 53.1% | 53.3% |

| Operating cost % of revenue | (24.9%) | (25.9%) |

| Contribution | £100.9m | £97.6m |

| % of revenue | 28.4% | 27.4% |

This is the UK’s second successive financial year of revenue and contribution growth.

The Business has continued implementing the Group strategy with its R&D Sales Division now fully operational and providing customer facing support. The Process Control and Automation product group has continued to grow strongly and the focus on selected target customer accounts has proved successful.

The Business’s revenue growth together with effective cost management have both contributed to a significant improvement in operating cost leverage evidenced by the 1% reduction in operating costs as a percentage of revenue for the year.

Back to topEBS

EBS integrated platform across

• UK, Continental Europe,

• Asia Pacific

| 2008 | 2007 | |

|---|---|---|

| EBS Costs | £14.4m | £19.0m |

The roll out of EBS in both Europe and Asia Pacific is now complete. By the year end, a single integrated regional system supported all our businesses across continental Europe and the UK and likewise across Asia Pacific.

The benefits to our European and Asia Pacific businesses of operating on their respective integrated platforms continue to be realised. This has shown itself in many areas, including more tailored customer discounting through to improved operating efficiencies in our businesses.

EBS costs have reduced by some £4.6m to £14.4m. This reduction in costs is due to significantly lower implementation costs as the roll out to operating companies within the two regions have come to an end.

For the year ending 31 March 2009 EBS costs will not be separately disclosed and the ongoing costs of depreciating the EBS assets, of around £13m, will be included within Process costs.

Back to topPROCESSES

Stock turn improved to

2.9 times

| 2008 | 2007 | |

|---|---|---|

| Process costs | £85.1m | £82.9m |

The Processes support our operating companies by ensuring that they have the products, infrastructure and expertise to provide consistently high service levels around the World. The costs have reduced year on year as a percentage of revenue by 0.2% points.

Information Systems

Information Systems supports and develops the enterprise system applications that are required by the Group. It enables the businesses to deliver sales growth and cost reductions by better exploiting our powerful EBS platform.

Supply Chain

The Supply Chain process is responsible for all the logistics surrounding product supply and the management of stock levels.

Its dual objectives have been to maintain high levels of customer service whilst exploiting the regional planning capabilities provided by EBS.

The benefits of this latter objective have become increasingly clear as the Supply Chain has exploited the new capabilities provided by EBS and improved stock turn from 2.7 to 2.9 times during the year.

Product Management

Product Management selects and purchases some 450,000 distinct products around the world.

During the year, Product Management increased the number of products in the electronics product portfolio and further rationalised the Maintenance range. Global sourcing activity increased with a growing proportion of products sourced via the Group’s Asia sourcing operation.

Media Publishing

The Media Publishing Process designs and produces the Group’s publications and associated content for e-Commerce. During the year the team upgraded the Group’s catalogue production systems providing efficiency gains, enabling the introduction of an enhanced continuous publishing capability and parametric search capability to the European websites.

Back to topCapital Structure

At the year end, net debt of £151m comprised gross borrowings of £179m (currency split: £86m in US Dollars, £35m in Euros, £39m in Japanese Yen, £2m in Sterling and the balance of £17m in other currencies), and financial assets of £28m (currency split: £20m in Sterling, £5m in Euros and the balance of £3m in other currencies). This currency mix is to manage the hedging of translation exposure, interest differentials and tax efficiency. The peak net borrowing during the year was £188m. In addition, the pension deficit (net of associated deferred tax) was £23.9m at 31 March 2008.

The Group's main sources of debt are a syndicated facility for US$120m and £110m from nine banks, a syndicated facility for £63.5m from three banks and a bilateral facility for £12.5m from one bank all maturing in February 2010. The bilateral facility was added during the year. Since the year end the Group has added a further facility of £25m.

Back to topTaxation

The Group’s effective tax rate is 33% of profit before tax which is 1% point lower than the rate in the prior year. This reduction is principally due to the lowering of local tax rates in some of the territories within which the Group operates and improved utilisation of overseas’ tax losses as such entities become more profitable. The Group’s current 33% tax rate includes the effect of a significant, and ongoing, increase in the deferred tax liability due to the tax amortisation of overseas goodwill. This deferred tax liability is not expected to crystallise in the foreseeable future. This, together with the differing timing of payments, results in the cash tax rate at 24% of profit before tax being significantly lower than the effective tax rate of 33%.

Back to top

Pension

The Group has defined benefit schemes in the UK, Ireland and Germany. All these schemes are now closed to new entrants. Elsewhere (including the replacement schemes in the UK and Ireland), the schemes are defined contribution.

Under IAS 19, the combined deficit of the defined benefit schemes was £30.0m at 31 March 2008.

The most recent valuation of the UK defined benefit scheme was carried out as at 31 March 2008. This disclosed a gross deficit of £21.8m. This deficit is £10.1m lower than at the previous year end. The principal reason for this improvement has been the recent higher discount rates.

To eliminate the deficit, based on the assumptions used in the valuation as at 31 March 2004, the Group has made additional annual payments to the scheme.

As part of the formal triennial valuation of the pension scheme at 31 March 2007, which has been agreed in principle with the Trustees of the scheme, the Group considered the prospective future cost and volatility of the UK defined benefit scheme structure. This has led to the Group concluding a consultation, on 3 April 2008, with the membership of the scheme over a number of proposed changes. These changes are designed to reduce the cost and volatility of maintaining the UK defined benefit scheme going forwards and are intended to apply from June 2008.

Back to topRisks

Electrocomponents has well established risk management procedures for the identification, assessment and management of risks to the Group’s business objectives.

The Board and Group Executive Committee receive regular reports covering risks and mitigating actions arising from external factors, key dependencies, project delivery and corporate responsibility factors. Our key business risks are as follows:

Macro Economic Environment

Slowdown in economic growth in key markets presents uncertainties for the business, however underlying growth potential in international markets continues to be positive.

Our business model is broad based. We provide a range of 450,000 products to 1.6 million customers globally, with an average order value of approximately £100. The sustained growth achieved by our international business operating directly in 26 countries now represents over 60% of Group revenue. This growth has progressively reduced our historic key market dependency and further strengthens the inherent resilience of our business model.

By exploiting investments in new capabilities such as in our new small batch production offer and e-Commerce developments, we are well placed to continue to deliver business success. We closely monitor relevant international economic indicators, and remain vigilant in anticipating wider macro economic trends.

Group Strategy Implementation

The risk is that the Group Strategy does not deliver sustainable business growth and profits. Factors that could influence the successful delivery of strategic objectives and timelines include macro economic uncertainties in key markets and our ability to deliver and support new, relevant and competitive customer offers and services.

Processes to drive Strategy success and to manage the significant risks include dedicated customer focussed teams to support the continual improvement of the ranges for R&D and maintenance engineers and supporting services, and detailed analysis of customer needs and feedback to ensure the offer remains relevant and competitive. The Group Executive Committee dedicates significant time to ensuring sufficient resources are available to deliver timely and effective actions to support the Strategy.

Pricing

Effective market pricing is central to the success of our business strategy. The risk is that inappropriate pricing or excessive discounting will undermine our customer offer and reduce gross profit and margin unnecessarily.

To effectively address these risks, we have robust pricing frameworks in place to respond quickly to market and competitor pricing developments. These processes ensure our customer communications pricing and service offers are both effective and relevant.

Comprehensive business processes are in place to ensure the close management of all elements of gross margin.

Back to topPeople

The expertise, commitment and support of our employees is central to our continued business success. Ensuring we maintain the right mix of skills, knowledge and experience to support a high performing organisational culture are key on-going challenges for the business.

We continuously seek to supplement our existing capabilities by both attracting new talent and by developing our employees. To ensure we remain an attractive place to work, we monitor employee views via regular surveys, market test our reward packages to maintain competitiveness with the external market, and provide an environment for our employees to further their personal development.

Formalised succession planning processes are in place at senior levels to build and deepen our organisational capabilities, whilst reducing our key person dependencies. High potential employees benefit from established career development programmes.

IT and Communication

The introduction of an integrated data network and infrastructure across our European and Asian businesses has significantly improved our organisational risk profile, providing more major business benefits, resilient infrastructure and region wide disaster recovery provision.

An integrated data network and infrastructure does introduce region wide dependencies on common systems solutions. To address this risk, we have concentrated on systems stabilisation activities, the development of our systems knowledge and experience, and the implementation of comprehensive incident management and business continuity planning processes.

As we have moved to systems stabilisation, our risk mitigation plans have focussed on the development of our e-Commerce capabilities, the reduction of communications and telephony risks, and maintenance of the highest standards of protection against external data and systems threats such as viruses and hacking.

Foreign exchange rates

The geographic spread of the Group means that its financial results can be affected by movements in foreign exchange rates. The Group has significant operations both in Europe and North America. Hence, by the way of example, a 10 cent weakening of both the Euro and US Dollar currencies against Sterling would create a translation exposure and reduce the Group's annual profit before tax by about £3m and £1m respectively.

The Group has a significant proportion of its borrowing denominated in Euros and US Dollars, which provide a hedge against the Group's European and North American investments.

Back to top

Corporate Responsibility

Management and Business Conduct

We are committed to sound Corporate Responsibility (CR) policies and practices as an integral part of our business model. We believe that the progressive alignment of our values and strategy with responsible and ethical business policies and practices helps enhance competitiveness and is a driver for sustainable growth and business success.

The Board takes regular account of CR matters in the business of the Group; the Group Chief Executive being the Board Director responsible for CR, health and safety and environmental matters at the Board.

Our Group Policy Manual defines our core values and principles we apply in dealing with our customers, suppliers and other stakeholders. The Manual also covers protecting our assets, competition law and conflicts of interest. We issue the Manual to our management population across the Group who must individually confirm receipt and ensure that employees are briefed on the contents. We have an independently operated “whistle-blowing” hotline which allows employees to report matters of concern “in confidence”.

The Group is a member of the FTSE4Good index and participates in the Carbon Disclosure Project. In 2008, Corporate Knights Inc., with Innovest Strategic Value Advisors Inc. placed Electrocomponents as one of their Global 100 most sustainable corporations.

Customers and Suppliers

The responsible selling, marketing and provision of product safety information to our customers are key elements of our business model. All suppliers are informed of our CR principles. All our direct suppliers in countries of concern undergo periodic audit by our regional sourcing teams using Ethical Trade Initiative guidelines, with 12% of direct suppliers being audited during the year.

Our customer service ethic is a core element of our strategy and business proposition, with 96% of our Group by turnover certificated to the ISO9001 Quality Management Standard.

Employees

We are committed to promoting and maintaining a working environment where employees are valued and respected, where there is equality of opportunity and where individual talent is recognised. The Report of the Directors sets out our approach.

Back to topEnvironment

Our most significant environmental impacts are the carbon emissions due to the consumption of energy in our facilities, the use of paper in our printed catalogues, waste management, packaging consumption and water use. We use key performance indicators (KPI’s) to assess and monitor the environmental performance of our sites and businesses. These KPI’s index the relevant environmental impact with respect to sales value.

During the year we issued a new Group Environmental Policy Statement which commits us to identifying and managing the key environmental impacts associated with our activities. Our focus will be on promoting greater efficiency in energy consumption, paper and packaging.

To support our policy, we will be extending ISO14001 Environmental Management Systems certification in more of our businesses. This includes a programme to ensure all our UK facilities are ISO14001 certified, and we are considering plans to certify a further five international sites by 2010. Currently 53% of our workforce is employed in ISO14001 certificated operations.

In 2007 we also upgraded the processes we use to gather and report environmental data to cover all our sites worldwide. As a result we report apparent increases in environmental impact in a number of areas.

We report below on our environmental impact for the 2007 calendar year. Where possible we have restated the 2006 data to reflect improved reporting and coverage.

Back to topEmissions

The reported CO2 emissions due to energy used at our premises per unit of sales increased by 1.5% for the 2007 calendar year. This increase was due to the parallel operation of the old and new Fort Worth warehouse and office facilities during the relocation of our North American business.

Excluding the effect of the Fort Worth business relocation, the underlying trend in CO2 emissions per unit of sales were reduced by 6.9%. The improvement was driven by the move to the new technology platform allowing for the decommissioning of redundant server equipment and data centres in Europe and the UK, and by the closure of older less efficient facilities such as the Turin trade counter.

Emissions KPIs

| Total Emissions (Tonnes CO2) |

Total Emissions (Tonnes CO2) per £m revenue |

|||

| 2007 | 2006 | 2007 | 2006 | |

|---|---|---|---|---|

| CO2 due to energy use * | 22,388 | 20,616 | 24.3 | 23.9 |

- *

- includes CO2 due to electricity (Country specific CO2 factors. 2006 data restated accordingly), natural gas and fuel oil use

Paper

With the support of our pulp suppliers and printers, we have sought to progressively reduce the carbon footprint of our paper catalogue production over the past four years. By introducing refinements to the grades of paper used and improvements to binding and covers over this period, we have managed to increase the number of catalogues printed by 8% whilst reducing the tonnage of paper consumed by 11%. This produces greater distribution efficiencies, cost savings and reduced emissions.

All the pulp for our European and Asian catalogues is sourced from either Forestry Stewardship Council (FSC) or PEFC accredited forests, with all the printing carried out by ISO14001 certificated facilities. From October 2008, all our European and Asian catalogues will carry FSC and PEFC “chain of custody” accreditation marks.

Our customer packaging is the subject of a working group which aims to reduce the quantity of packaging sent on our deliveries to customers, whilst ensuring customer orders are properly protected against damage. This will also provide customers with the necessary information to ensure they are able to increase the reuse and recycling of packaging as appropriate.

Waste

The upgrade of our environmental reporting processes during 2007 has enabled us to capture more accurate data concerning our waste management performance. As a result apparent levels of waste generation increased during the year.

Some 75% of our waste was recycled in 2007 with a number of challenging initiatives launched across the business including, for example, the removal of desk bins in the UK business and their replacement with recycling points.

Waste KPIs

| Total Waste (Tonnes) |

Total Waste (Tonnes) per £m revenue |

|||

| 2007 | 2006 | 2007 | 2006 | |

|---|---|---|---|---|

| Total waste | 2,070 | 1,421 | 2.1 | 1.6 |

| Recycling | 1,545 | 1,270 | 1.7 | 1.5 |

- *

- Year on year comparisons are not fully valid due to upgraded 2007 data collection processes

Water

Apparent water consumption increased in 2007, however the increase was principally due to the commissioning and parallel operation of our new Fort Worth facility.

The increase in water consumption in North America had been anticipated, and was linked directly to Allied Electronics moving into its new office and warehouse facilities. Activities such as landscaping, cleaning and testing of warehouse fire protections led to significant one-off additional increases. Excluding the effect of the second North American site, there was a reduction in 2007 of water consumption per unit of sales of 1.1%.

Water KPIs

| Total Water Consumption (m3) | Water Consumption (m3) per £m revenue |

|||

| 2007 | 2006 | 2007 | 2006 | |

|---|---|---|---|---|

| Total water use* | 52,008 | 40,972 | 56.4 | 47.5 |

- *

- Year on year comparisons are not fully valid due to upgraded 2007 data collection processes

Health and Safety

The Group Executive Committee receives health and safety reports on a quarterly basis, and the Group Chief Executive reports to the Board on health and safety matters at least annually. Our health and safety management processes are based on the application of risk management techniques and on Occupational Health & Safety Standard OHSAS18001, with our health and safety performance presented by financial year.

During 2008 we made further progress in health and safety performance, with businesses successfully delivering a wide range of health and safety objectives, with reductions in accident rates at many locations.

The total number of accidents reported from across the Group fell relative to 2007, with the “All Accident” rate improving by 11%, although the “lost time” accident rate remained relatively static. The total number of employee lost days due to injury at work totalled 570 days, or 0.044% of working hours.

Health and Safety KPIs

| 2008 | 2007 | |

|---|---|---|

| Lost time accidents * per 100,000 hours worked | 0.35 | 0.33 |

| All accidents per 100,000 hours worked | 3.04 | 3.39 |

- *

- Lost time accidents are those where the employee is off work for at least 24 hours

The most common causes of accidents are manual handling activities, followed by slips, trips and falls. Our UK business has championed the use of behavioural safety techniques to support safety training in higher risk activities, and these lessons are being applied across the Group.

The numbers of employees attending health and safety training during the year increased by 11.5%, and a drive on reporting “near miss” accidents, were significant factors in addressing accident performance.

We continue to support the reduction of safety risk at our facilities by targeted investments, including for example the removal of the last cooling towers in the Group to significantly reduce Legionella risk, the investment in new lift trucks at our main warehouse sites, and the introduction of increased mechanisation and use of labour saving equipment to reduce manual handling injuries.

Back to topVerification

Electrocomponents evaluates its CR policies and performance as part of its risk management and internal audit processes. Those locations accredited to ISO9001, ISO14001 and OHSAS18001 have regular audit by external agencies.

Our environmental reporting processes and data are reviewed by our Operational Audit Department, and our Group Risk Manager works with external consultants to review and, where appropriate, verify our environmental key performance indicators.

We consider that these procedures provide a reasonable level of assurance that our non-financial key performance indicators are free from material misstatement. Whilst we have considered the potential for further external verification of the Group’s CR performance we have decided that currently we will limit this to external professional advice on specific matters as required.

Back to top

Print

Print Bookmark

Bookmark