Operating and financial review

This review includes a description of 3i’s business and

strategy and comments on 3i’s performance during the year in the

context of the economic and market environment and other

influences. The review also discusses 3i’s financial position,

including changes to its capital structure, and comments on the

main risks inherent in 3i’s business and the framework used to

manage them.

3i’s business and strategy

3i’s business

3i’s business focus continues to be to invest in buy-outs, growth

capital and venture capital. Geographically, most of our investment

is in businesses based in western Europe, although 3i does have

growing investment operations in the US and in the Asia Pacific

region. In the US, 3i currently invests in businesses engaged in

technology sectors; while elsewhere 3i invests across a broader

range of industry sectors and in each of the investment activities

identified above.

Buy-outs

3i invests in European mid-market buy-out transactions with a value

between €25 million and €800 million. The vendors of the businesses

being sold are typically large corporates disposing of non-core

activities or private groups with succession issues.

3i targets the mid-market because that is where we believe we

can create the most value. There is less competition for

transactions in this market than for larger deals and price is less

likely to be the sole or key criterion in “winning the deal” – we

believe that, in the mid-market, the relationships we build through

our local presence are just as important. Additionally, the nature

and size of businesses in this market are such that we are more

able to add value through strategic, operational and management

input; and, in this market, the underlying businesses will

generally have greater growth potential than larger ones and be of

such a size as to make them more attractive acquisition targets for

a greater number of strategic purchasers.

3i is also active in the smaller buy-out market (below €25

million), both in western Europe and in the Asia Pacific region.

This is a more fragmented segment of the market and one in which

3i’s local network provides good access to the private vendors,

management teams and local advisers involved.

Growth capital

3i makes growth capital investments of between £5 million and £50

million, across a broad range of sectors, business sizes and

funding needs. These investments typically involve 3i acquiring

minority stakes in established businesses. We therefore seek to

ensure a high level of influence and an attractive yield in these

situations. 3i’s growth capital business is primarily focused on

3i’s European and Asia Pacific markets and has historically had a

less competitive environment than buy-outs.

Success in this market is determined by the ability to build

long-term relationships with local businesses and local

intermediaries, as well as demonstrating the capability of helping

these businesses to grow. This fits well with 3i’s strategy of

local presence, sector specialisation, sharing knowledge and

offering local businesses access to 3i’s international network of

relationships.

Venture capital

3i’s venture capital business is targeted at four key sub-sectors –

healthcare, communications, software and electronics,

semiconductors and advanced technologies (“ESAT”). The main

geographic focus is western Europe and the US, though 3i does also

invest in the Asia Pacific region.

Investment in venture capital takes the form of participation in

a series of “funding rounds” and we therefore separate out “first

investments” (those in businesses where 3i is not already invested)

and “further investments”. 3i aims to invest between £1 million and

£10 million in each new opportunity and, depending on circumstances

and market conditions, we would generally expect 3i’s venture

capital investment to be split broadly 50:50 between first

investments and further investments in any year.

3i’s strategy

The key elements of 3i’s strategy are as follows:

- to develop the business internationally;

- to build a balanced investment business;

- to use the network as our key competitive advantage; and

- to invest in companies where there is potential to grow profits

significantly.

Globally, private equity and venture capital investment is

concentrated in the US and Europe, with the Asia Pacific region

showing strong growth. We currently have a strong European presence

and aim to grow our activities in the US and Asia. 3i targets

investment across a broad range of industrial sectors and also

invests at all stages of the corporate lifecycle, from start-ups to

buy-outs. We continue to target businesses where we believe we can

help to grow profits significantly.

Integral to our strategy is the ability to use 3i’s network to

generate returns that are greater than those of our competitors. As

business becomes increasingly international and complex, we believe

that the network provides 3i with real competitive advantage

through each phase of the investment lifecycle – origination of the

investment opportunity, developing and validating the business

case, structuring and making the investment, implementing the

operational plan for the business, and exit.

The main elements of what we refer to as “our network” are as

follows:

- local presence – this enables 3i to build strong relationships

with entrepreneurs, corporates, universities, research

organisations and intermediaries, and is particularly important in

the deal origination phase of the investment lifecycle;

- sector specialisation – underpinning 3i’s ability to build

meaningful business relationships, sector specialisation is

critical in the phases of developing and validating the investment

case and subsequently implementing the growth strategy. Our sector

teams are drawn from 3i’s Industry Group, which comprises around 20

experienced senior industry specialists, and 3i’s investment and

portfolio management executives;

- “product” specialisation – each of buy-outs, growth capital and

venture capital has teams of specialist investment executives

skilled in project management and financial structuring specific to

the product. 3i’s scale and structure also allow us to utilise

specialist skills in a number of other areas, including portfolio

management, restructuring and turnarounds, and exits and IPOs of

companies from 3i’s portfolio;

- sharing knowledge and contacts – the importance of knowledge

and strong relationships in each phase of the investment lifecycle

is difficult to overstate in the private equity and venture capital

investment business and, for 3i, the benefits of sharing these

across the organisation represent a substantial source of

competitive advantage. We believe we have in place the systems,

processes and structures and, as importantly, the corporate culture

to help 3i maximise the potential benefits;

- relationships with corporates – another benefit of 3i’s scale

and organisation is that we have meaningful relationships with a

large number of corporates in each of the geographies in which we

operate. These relationships are particularly useful at the

origination, investigation and exit phases of an investment.

Furthermore, 3i’s ability to make effective business introductions

across a range of geographies is increasingly a critical factor in

our ability to “win deals” and provides 3i with a distinctive

source of value creation; and

- strengthening boards and management teams – the “People

Programmes” 3i runs for chairmen, chief executives, chief financial

officers and independent directors provide an excellent resource

for building and strengthening boards and operational management;

and are also a strong source of both investment opportunities and

due diligence capability.

Organisation and office network

There have been no changes since March 2003 in the leadership of

our three investment businesses. Jonathan Russell continues to lead

the pan European mid-market buy-out business; Chris Rowlands leads

the growth capital and smaller buy-out business; and Rod Perry

leads the venture capital business.

Within each of these activities, a panel of our most experienced

investors ensures rigorous application of our investment processes

and provides guidance to help ensure we maximise value across each

phase of the investment lifecycle. These panels also seek to

ensure, on a case-by-case basis, that we assemble “the best team

for the job” from the regional, sector and product specialists.

The investment and divestment approval functions for larger

transactions are carried out by two Investment Committees,

addressing technology and non-technology investments respectively.

The membership of these Investment Committees is drawn from 3i’s

Executive Committee.

3i’s Smi (small and medium-sized investments) initiative, which

was established in 2001 and which reports to Chris Rowlands,

continues to be successful in generating returns from some of the

older and lower-growth investments and, importantly, in enabling

non-Smi investment professionals to focus on identifying investment

opportunities and managing larger investments. At 31 March 2004,

£698 million of value (16% of 3i’s total portfolio) and 849

investments (45% by number of 3i’s total portfolio) were managed by

the Smi team.

There were no changes to the office network during the year,

though we have just announced that 3i’s offices in Padua and Nantes

will close in the summer of 2004. 3i will then have a total of 29

offices (25 across Europe and two each in the US and the Asia

Pacific region). We continue to recognise the need to deploy

resources through critical mass teams based in locations of

greatest opportunity. To this end, 3i’s Glasgow, Bristol and Leeds

offices were, in February, directed to focus on portfolio

management, with the executives responsible for new investment in

these offices being redeployed. We do not anticipate any

substantial changes to the current network of offices.

During the year, headcount was reduced from 858 to 750,

reflecting a continued application of the cost reduction measures

and changes in investment processes and resource alignment

initiated over recent years.

Operating review

Macroeconomic and market conditions

The macroeconomic environment in the regions where 3i has

operations improved substantially during the financial year under

review. Looking at the period as a whole, perhaps the key defining

features of the economic environment were as follows: gradually

improving consumer and business confidence from the lows

experienced during the extended build-up to hostilities in Iraq,

though ongoing geo-political uncertainty appears to be a fact of

life; the significant strengthening during the period of sterling

and the euro compared with the US dollar and a number of Asian

currencies, which has impacted the competitive position of a number

of our portfolio businesses; improving economic growth outlook for

the US and, to a lesser degree, for Europe, though across most of

Europe levels of government spending remain high; and the strength

of the Chinese economy and the implications of this for western

economies and businesses.

Stock market conditions and mergers and acquisitions (“M&A”)

activity levels also showed improvement through the financial year.

Most stock market indices rose substantially, reflecting improving

confidence in underlying economic growth and the prospects for

corporate earnings. The increased business confidence, improving

stock market conditions and continuing low interest rates are all

enabling and encouraging businesses to recommence their disposal

and acquisition strategies, though the number of completed M&A

transactions remains subdued, both in Europe and globally.

The private equity and venture capital markets are also showing

increased activity after a slow first half of 2003. Market

statistics for 2003 show that total private equity and venture

capital investment in Europe fell by 16.5% compared with 2002, with

“high technology” investment down 25%, “growth” investment down by

29.4% and buy-out investment down by 9.5%. The second quarter

experienced the lowest levels of investment (as expected, given the

prevailing uncertainty and consequent deferment of business

decisions), with strong increases in the third and fourth

quarters.

Elsewhere, the “high technology” segment of the market in North

America showed a 5% increase in total investment over 2002; and

investment levels in Asia Pacific rose very substantially in 2003

to a new “all-time high”.

Conditions for realisations were difficult for most of 2003,

with relatively few active trade buyers and continuing low levels

of IPOs by historical standards. Market statistics for Europe show

a 25% fall in the number of divestments in 2003 compared with 2002.

However, we are seeing encouraging levels of renewed interest by

trade buyers for strategic assets and the IPO markets are showing

signs of re-opening, at least for strongly performing and

profitable businesses.

There were also a number of features specific to the markets of

each of our three investment businesses. Activity in the pan

European mid-market for buy-outs was driven largely by strategic

reorganisation and restructuring initiatives within conglomerates

under continuing pressure to sell off non-core assets and manage

their balance sheets. In addition, secondary buy-outs (where a

private equity investor buys a business from another private equity

investor) were a significant feature during the period, accounting

for 31.3% of investment (by transaction value) in 2003. This is a

reflection of the amount of buy-out funds raised and seeking

investment opportunities and also, on the sell side, of the

pressure on some funds to sell investments and return cash to

investors.

Within the European growth capital market, investment in 2003

was down sharply on 2002, largely as a result of growth and

acquisition plans being deferred in an environment of business

uncertainty during the first half of the year. Since then, these

strategies have increasingly been recommenced and we believe that

the use of private equity to facilitate cross-border expansion

within the European market is a key driver of investment

opportunity.

The venture capital markets are seeing increased levels of IT

spending by businesses as well as improved conditions for

realisations as the appetite of corporates for buying

venture-backed businesses improves and stock markets re-open to

some extent to technology companies. Reduced levels of competition

following the fallout from the “technology bubble” are also a

feature of the marketplace in Europe, though competition for

particularly good opportunities is still significant.

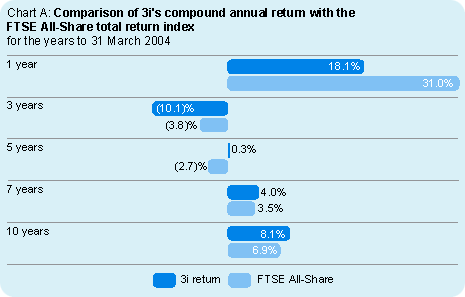

Total return

3i achieved a total return of £531 million for the financial year,

which equates to 18.1% on opening shareholders’ funds. While this

compares with returns on the FTSE 100 and FTSE All-Share total

return indices of 25.7% and 31.0% respectively, it is normal that

3i’s returns lag an upturn in quoted markets. This is because our

valuations of unquoted investments are generally based on

historical earnings and our venture capital investments are not

marked up in line with a rise in quoted markets.

The components of the total return are shown in table 1; and

table 2 contains an analysis of total return by business and

geography.

|

|

|

| |

| Table 1: Total return |

|

|

| |

2004 |

2003 |

| |

£m |

£m |

| Total operating income before interest payable |

267 |

308 |

| Interest payable |

(93) |

(110) |

| Management expenses |

(163) |

(163) |

| Realised profits on disposal of investments |

228 |

190 |

| Unrealised profits/(losses) on revaluation of investments |

336 |

(1,159) |

| Carried interest and investment performance plans |

(40) |

(12) |

| Other |

(4) |

11 |

| – Revenue return |

134 |

146 |

| – Capital return |

397 |

(1,081) |

| Total return |

531 |

(935) |

|

|

|

|

|

|

|

|

| |

| Table 2: Total return by business and geography (£m) |

| year to 31 March 2004 |

| |

UK |

Continental

Europe |

US |

Asia Pacific |

Total |

| Buy-outs |

123 |

185 |

(4) |

31 |

335 |

| Growth capital |

238 |

(16) |

1 |

8 |

231 |

| Venture capital |

25 |

(28) |

(24) |

(8) |

(35) |

| Total |

386 |

141 |

(27) |

31 |

531 |

| |

|

|

|

|

|

| Returns are stated after currency translation losses. |

|

|

|

|

|

The main drivers of the total return were a good level of

profitable realisations and strong growth in the value of the

portfolio. The latter was due to two main factors: the use of

higher earnings multiples, as a result of rising stock markets; and

a good level of “first-time uplifts” on a number of recent

investments in the mid-market buy-out portfolio as they moved from

being valued at cost to being valued on the earnings basis. The

total return also reflects an unrealised loss on foreign currency

translation of £64 million, arising on 3i’s euro- and US

dollar-denominated portfolios net of currency borrowings, as

sterling appreciated over the year relative to the euro (up 3%) and

the US dollar (up 16%).

Improved results in each of 3i’s business areas underpinned the

overall return. The mid-market buy-out return of 22.6% (on opening

shareholders’ funds attributed to this activity) was largely driven

by growth in the value of the portfolio, with strong first-time

uplifts on a number of recent investments and a minimal level of

provisions. Returns in the smaller buy-out and growth capital

businesses, of 22.1% and 26.8% respectively, were driven by strong

realisations, while the portfolios increased in value mainly as a

result of using higher earnings multiples. Both businesses

continued to generate a good income yield. The venture capital

business produced a total return of (6.0)%, though its return was

broadly break-even before the impact of foreign currency

translation losses. There were a small number of funding rounds at

higher company valuations, allowing us to increase the carrying

value of these investments, but we have not sought to reflect in

the valuations of unquoted venture capital investments the

significant rise in quoted technology indices over the year.

Geographically, 3i’s returns in the UK, continental Europe and

Asia Pacific were strong. The return in the UK of 22.2% was driven

mainly by a high level of profitable realisations and healthy value

growth in the portfolio. Whilst the buy-out and growth capital

businesses were the main contributors to the UK’s return, the

venture capital business also achieved a positive return.

In continental Europe, 3i’s return of 14.5% (17.5% before the

impact of unrealised foreign currency translation losses of £29

million) was largely due to the high level of first-time

uplifts.

In Asia Pacific, the sale of our investment in Vantec

Corporation, the logistics business acquired from Nissan in 2001,

was the main contributor to our 34.3% return.

The US business made a loss of (7.4)% before taking account of

the £17 million translation difference arising on the

dollar-denominated portfolio (net of dollar borrowings).

Investment

3i invested a total of £784 million (£979 million including

investment on behalf of co-investment funds), which is a 9.5%

increase over the prior year.

During the first half of the year, 3i invested £211 million,

with the balance of £573 million being invested in the second half.

The substantial increase in the second half was largely due to 3i’s

ability to complete new investment opportunities that had built up

in the new investment pipeline up to 30 September – in contrast to

the low pipeline coming in to the financial year, reflecting the

deferral of many strategic decisions by businesses and investors in

an environment of business uncertainty during the extended build-up

to the hostilities in Iraq.

An analysis of the amount invested by business and geography is

given in table 5. Buy-out transactions represented 42% of total

investment, growth capital 37% and venture capital 21%. Of the

amount invested in venture capital, 55% was further investment into

existing portfolio companies.

Continental European investment represented 51% of investment,

up from 42% in the prior year, and is a reflection of our ability,

through the network, to source and complete larger deals across

Europe. The UK represented 39% (down from 44%), with the US and

Asia Pacific investing 8% and 2% respectively.

|

|

|

| |

| Table 3: Summary of changes to investment portfolio |

| |

2004 |

2003 |

| |

£m |

£m |

| Opening portfolio |

3,939 |

5,109 |

| Investment |

784 |

716 |

| Realisation proceeds |

(923) |

(976) |

| Realised profits on disposal of investments |

228 |

190 |

| Unrealised profits/(losses) on revaluation of investments |

336 |

(1,159) |

| Other |

(38) |

59 |

| Closing portfolio |

4,326 |

3,939 |

| |

|

|

|

|

|

|

|

|

| |

| Table 4: First and subsequent investment |

|

|

| |

2004 |

2003 |

| |

£m |

£m |

| New first investments |

535 |

432 |

| Further funding or drawdown on existing arrangements |

249 |

284 |

| Total |

784 |

716 |

|

|

|

|

|

|

|

|

| |

| Table 5: Investment by business and geography (£m) |

| |

| |

UK |

Continental

Europe |

US |

Asia Pacific |

Total |

| |

2004 |

2003 |

2004 |

2003 |

2004 |

2003 |

2004 |

2003 |

2004 |

2003 |

| Buy-outs |

86 |

163 |

240 |

149 |

– |

– |

– |

– |

326 |

312 |

| Growth capital |

166 |

112 |

111 |

75 |

3 |

32 |

9 |

15 |

289 |

234 |

| Venture capital |

57 |

43 |

50 |

80 |

58 |

42 |

4 |

5 |

169 |

170 |

| Total |

309 |

318 |

401 |

304 |

61 |

74 |

13 |

20 |

784 |

716 |

|

|

|

|

|

Realisations

Despite a relatively poor environment for realisations, 3i

generated good realisation proceeds of £923 million (2003: £976

million) and strong realised profits of £228 million (2003: £190

million). Realised profits are stated net of write-offs, which

amounted to £50 million (2003: £79 million).

The aggregate uplift over 31 March 2003 valuations on equity

realisations was 58% and, including sales and redemptions of loans

and fixed income shares, 18% of the opening portfolio was

realised.

Table 6 shows an analysis of realisation proceeds by business

and geography. The growth capital and smaller buy-out businesses

were particularly active in generating realisations, mainly through

a focus on selling investments that have been in the portfolio for

several years.

|

|

|

| |

| Table 6: Realisation proceeds by business and geography (£m) |

| |

UK |

Continental

Europe |

US |

Asia Pacific |

Total |

| |

2004 |

2003 |

2004 |

2003 |

2004 |

2003 |

2004 |

2003 |

2004 |

2003 |

| Buy-outs |

229 |

467 |

178 |

142 |

– |

– |

57 |

4 |

464 |

613 |

| Growth capital |

303 |

199 |

34 |

66 |

– |

– |

2 |

5 |

339 |

270 |

| Venture capital |

76 |

61 |

33 |

30 |

10 |

2 |

1 |

– |

120 |

93 |

| Total |

608 |

727 |

245 |

238 |

10 |

2 |

60 |

9 |

923 |

976 |

|

|

|

|

|

Sales of quoted equity benefited from the general rise in equity

markets, with £40 million of profits generated over 31 March 2003

valuations (an uplift of 51%). Four investee companies achieved

IPOs during the year, with the most high profile probably being

that achieved by Cambridge Silicon Radio (“CSR”) in February (see

case study). The

successful IPO of CSR, a leading manufacturer of single-chip

Bluetooth wireless devices, at a market capitalisation of £240

million was seen as a key test of the stock market’s appetite in

Europe.

Unrealised value movement

The unrealised value movement on the revaluation of investments was

a positive £336 million, representing a significant improvement on

the £1,159 million value reduction in the prior year. An analysis

of the different components of the value movement is given in table

7.

|

|

|

| |

| Table 7: Unrealised profits/(losses) on revaluation of investments |

| |

|

|

| |

2004 |

2003 |

| |

£m |

£m |

| Earnings multiples |

287 |

(244) |

| Earnings |

(37) |

48 |

| First-time valuation uplift from cost |

238 |

31 |

| Provisions |

(143) |

(379) |

| Down rounds and restructuring |

(70) |

(361) |

| Other movements on unquoted investments |

1 |

(45) |

| Quoted portfolio |

60 |

(209) |

| Total |

336 |

(1,159) |

|

|

|

|

|

The weighted average earnings multiple applied to investments

valued on an earnings basis rose from 8.1 to 12.0 over the period.

The impact of increased earnings multiples on investments valued on

an earnings basis at the start and end of the year generated value

growth of £287 million (2003: £244 million value reduction).

There was a fall of 4% over the year in the aggregate

attributable earnings of investments valued on an earnings basis at

the start and end of the year, giving rise to a value reduction of

£37 million (2003: £48 million value increase). Two larger

investments whose profits fell significantly during 2003 were the

main components of this value reduction, but the fall in earnings

is also due to the use of historical audited accounts (therefore

not reflecting the more recent upturn in the economic environment)

in valuing most of this component of the portfolio.

It should be noted (by reference to table 7) that the value

movement relating to first-time uplifts includes £71 million which

is due to earnings growth and that the “other movements on unquoted

investments” item includes £7 million in respect of companies that

recovered from making losses to being profitable. The net value

movement due to earnings growth is therefore a £41 million

increase.

First-time uplifts totalled £238 million (2003: £31 million).

This is a reflection of the quality of investments made in recent

years and the results beginning to come through as value growth

strategies in investee businesses are implemented.

Provisions for investments in businesses which may fail totalled

£143 million (2003: £379 million) and valuation reductions relating

to the application of our downround methodology and restructuring

provisions fell significantly to £70 million (2003: £361 million).

The latter figure is stated net of valuation increases of £65

million, arising as a result of investee companies raising funds

from new investors at increased values.

The quoted investments held at the end of the year increased in

value by an aggregate £60 million over the year.

Carried interest and investment performance plans

Market practice in the private equity and venture capital industry

is to offer investment staff the opportunity to participate in

returns from successful investments. Amounts payable on the

successful realisation of investments in the year to 31 March 2004

totalled £8 million. A further £32 million has been accrued in

respect of amounts potentially payable if assets are ultimately

realised at the values they were held at in the accounts at 31

March 2004.

Income and costs

The main elements of income and costs are shown in table 1.

Total operating income before interest payable was £267 million

(2003: £308 million). The decrease when compared with the prior

year reflects a lower level of special interest and dividend

receipts during the year and the realisation of a small number of

higher yielding investments. Fee income is marginally lower than in

the prior year, although there was a substantial increase in the

second half of the year, with arrangement and negotiation fees

contributing strongly.

Net interest payable decreased, reflecting the reduction in net

borrowings and also the lower average rate of interest on long-term

borrowings following the €550 million convertible bond issue in

August 2003.

Management expenses of £163 million (2003: £163 million) include

fundraising costs of £6 million incurred in connection with the

Eurofund IV fundraising and a higher level of staff bonuses than in

the prior year.

The portfolio

At 31 March 2004, the portfolio comprised 1,878 investments, a

reduction from 2,162 a year earlier and a reflection of the

strategy of seeking exits from investments where we believe the

value growth potential is not sufficiently attractive. We would

expect this number to continue to decrease over the medium

term.

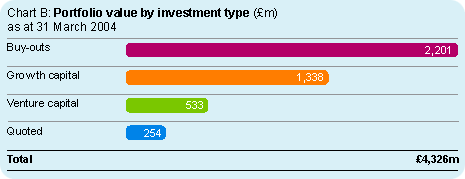

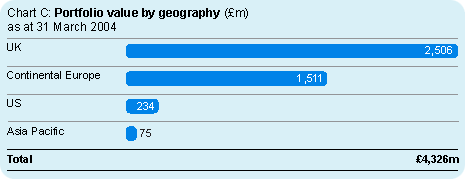

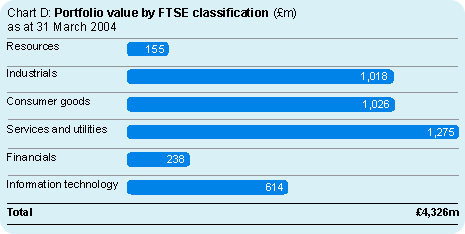

Charts B, C and D show the portfolio analysed by investment

type, geography and sector respectively and demonstrate the balance

we seek in the business. At the year end, 53% of the portfolio is

represented by buy-outs, 35% by growth capital investments and 12%

by venture capital investments. Geographically, 58% is in the UK,

35% in continental Europe, 5% in the US and 2% in Asia Pacific.

3i’s portfolio, in contrast to many others in the private equity

and venture capital industry, has relatively low exposure to

individual company risk, with the top 10 investments representing

13% by value at the year end and the top 50 investments 35%.

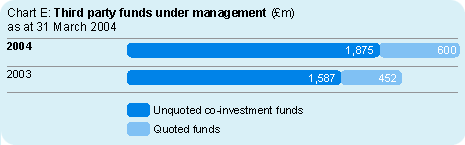

Fund management activities

Fund management activities comprise the management of both private

equity funds and quoted funds.

The private equity funds are primarily co-invested alongside

3i’s own capital when financing buy-outs, enabling an investment to

be made without 3i holding a majority interest. During the year, 3i

earned fee income of £31 million (2003: £34 million) from the

management of private equity funds. In addition, 3i receives

carried interest in respect of third-party funds under management.

During the year, 3i received

£1.7 million in respect of realised investments and accrued an

additional £1.7 million in respect of unrealised investments. At 31

March 2004, the invested portfolio managed on behalf of private

equity fund investors was valued at £1,324 million (2003: £1,158

million), excluding undrawn commitments.

During the year, we announced that the final closing of Eurofund

IV, the latest fund targeted at pan European mid-market buy-outs,

would take place by 30 June 2004. It is expected that third party

commitments will amount to at least €800 million over the life of

the fund, enabling 3i (together with the fund) to invest up to €3

billion in buy-outs over the next three years.

3i Asset Management manages 3i’s portfolio of quoted investments

(comprising principally our holdings in investments that have

achieved an IPO) as well as the portfolios of the 3i Group Pension

Plan and of three quoted specialist investment companies (3i

Smaller Quoted Companies Trust plc, 3i Bioscience Investment Trust

plc and 3i European Technology Trust plc). At 31 March 2004, total

third party quoted funds under management were £600 million. Fees

earned from quoted fund management amounted to £4 million (2003: £4

million).

Accounting policies and valuation

New valuation methodology

In August 2003, the British Venture Capital Association (“BVCA”)

issued new valuation guidelines for private equity and venture

capital investments, which resulted in changes being made to 3i’s

portfolio

valuation methodology. The new methodology has been approved by

the Board and was applied in carrying out the 31 March 2004

portfolio valuation. The net impact of these changes on the overall

valuation of the portfolio was immaterial.

Changes to accounting policies

There have been no changes to accounting policies during the

year.

Introduction of international financial reporting

standards

In June 2002, the European Union adopted a regulation that

requires, from 1 January 2005, European listed companies to prepare

their consolidated financial statements in accordance with

international accounting standards. 3i’s 31 March 2006 financial

statements will therefore be prepared in accordance with

International Financial Reporting Standards (“IFRS”). These

comprise not only IFRS but also International Accounting Standards

(“IAS”). Details of 3i’s implementation programme are discussed

within Accounting

policies.

Financial review

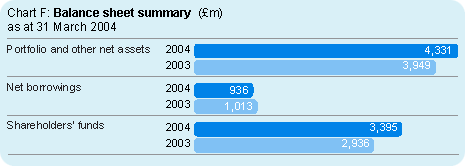

Cash flows

The key cash flows during the year were the aggregate cash outflow

of £756 million in respect of investment and cash inflows totalling

£913 million in respect of proceeds received on realising

investments. Net cash inflow for the year was

£45 million (2003: £170 million), reducing net borrowings at the

year end to

£936 million (2003: £1,013 million). With the significant growth in

the value of the portfolio during the year, gearing fell to 28% at

31 March 2004 compared with 35% a year earlier.

Capital structure

3i’s capital structure comprises a combination of shareholders’

funds, long-term borrowing, short-term borrowing and liquid

treasury assets and cash.

The major changes in capital structure during the year, other

than the growth in shareholders’ funds, were the €550 million

convertible bond issue completed in August 2003 and the replacement

of the £625 million multi-currency facility in January with a new

€595 million revolving credit facility. The convertible bonds are

due in 2008 and have a conversion price of 842p (a 45% premium to

the “reference price” of 580p) and an annual coupon of 1.375%.

Long-term borrowing at 31 March 2004 is £1,595 million and is

repayable as follows: £5 million between one and two years, £944

million between two and five years and £646 million after five

years. In addition, at the year end, 3i had committed and undrawn

borrowing facilities amounting to £583 million and cash and other

liquid assets totalling £819 million. We are confident we have in

place adequate funding for foreseeable investment needs.

3i Group plc has credit ratings with Moodys and Standard &

Poor's of Aa3/stable and A+/stable respectively.

Regulation and risk management

Introduction

3i Group plc and relevant subsidiaries continue to be authorised

and regulated by the Financial Services Authority.

3i has a comprehensive framework to manage the risks that are

inherent in its business. This framework includes a risk committee

whose purpose is to monitor the identification, assessment and

management of key risks across the business. The main risks

comprise economic risk, treasury and funding risk, investment risk

and operational risk.

Economic risk

3i invests mainly in European companies and continues to develop

its operations in the US and Asia Pacific. However, the majority of

the portfolio (58%) is still in UK companies and there is an

element of exposure to the UK economic cycle. To mitigate this, 3i

has invested in different sectors of the UK economy with different

economic cycles. In addition, an increasing proportion of assets is

invested in continental Europe, in the US and in Asia Pacific,

which may have different economic cycles.

Treasury and funding risk

The overall funding objective continues to be that each category of

investment asset is broadly matched with liabilities and

shareholders’ funds, with corresponding characteristics in terms of

risk and maturity, and that funding needs are met ahead of planned

investment. This objective continued to be met during the year

ended 31 March 2004.

All assets and liabilities are held for non-trading purposes

and, as a result, 3i does not have a trading book. 3i does not

trade in derivatives and does not enter into transactions of either

a speculative nature or unrelated to 3i’s investment activities.

Derivatives are used to manage the risks arising from 3i’s

investment activities.

The main funding risks faced by 3i are interest rate risk and

exchange rate risk. The level of these risks is mitigated by the

overall funding objective and the Board regularly reviews and

approves policies on the approach to each of these risks.

3i’s policy for exchange rate risk management is not generally

to hedge its overall portfolio in continental Europe or the US. In

line with its funding policy, part of those assets are funded by

borrowings in local currency and, as a result, a partial hedge

exists. 3i’s largest exposure is £0.8 billion in respect of net

assets denominated in euros in continental Europe. The level of

exposure to exchange rate risk is reviewed on a periodic basis.

Day to day management of treasury activities is delegated to

executive Directors and the Group Treasurer. Regular reports on

3i’s funding position have been considered during the year by the

Board. There has been no change during the year or since the year

end to the major funding risks faced by 3i, or to 3i’s approach to

such risks.

Investment risk

This includes investing in companies that may not perform as

expected, being over exposed to one sector of the economy and the

portfolio valuation being partly based on stock market

valuations.

Investment levels are set, allocated and monitored by product

area and geography. Within this framework, 3i invests in all

sectors of the economy, except those, such as property, where the

opportunity to invest in private equity and venture capital backed

businesses meeting 3i’s investment criteria is limited. Management

periodically reviews the portfolio, which is well diversified by

industry sector, to ensure that there is no undue exposure to any

one sector.

3i’s investment criteria focus on management ability and market

potential. Investment appraisal and due diligence are undertaken in

a rigorous manner by drawing on our international network and

experts in individual industry sectors. In general, proposed

investments over £5 million are presented to 3i’s Investment

Committee or Technology Investment Committee, which are committees

of senior management including executive Directors.

The valuation of a large proportion of 3i’s equity portfolio is

based on stock market valuations for the relevant industry sector.

Quoted investments are valued using the closing mid-market price at

the balance sheet date. 48% of the unquoted portfolio is valued

using stock market earnings multiples for the relevant industry

sector discounted for non-marketability. Accordingly, stock market

valuations for individual sectors are an important factor in

determining the valuation of 3i’s portfolio and the total

return.

There are regular reviews of holdings in quoted companies and

exposure to individual sectors in order to monitor the level of

risk and mitigate exposure where appropriate. In particular, the

level of future funding of technology companies is kept under

review. However, it is not possible to protect against the risks of

a downturn in stock markets generally or in any specific

sector.

Accordingly, the valuation of 3i’s portfolio and opportunities

for realisation depend on stock market conditions and the buoyancy

of the wider mergers and acquisitions market.

Operational risk

This includes operational events such as human resources risks,

legal and regulatory risks, IT systems problems, business

disruption and shortcomings in internal controls.

Line management at all levels is responsible for identifying,

assessing, controlling and reporting operational risks. This is

supported by a framework of core values, standards and controls, a

code of business conduct and delegated authorities.

The ability to recruit, develop and retain capable people is of

fundamental importance to achieving 3i’s strategic objectives. We

operate in a competitive industry and aim to remunerate our staff

in line with market practice and to provide superior development

opportunities.

A group-wide business continuity strategy is in place. This

strategy has been assessed against a detailed business impact

analysis and independently benchmarked against best practice.

Conclusion

The year under review saw a strong return on opening shareholders’

funds, driven mainly by healthy realisation profits and good value

growth from the portfolio. In addition, 3i took advantage of

improving conditions to invest just under £1 billion (including

co-investment funds) in good businesses with attractive growth

prospects.

3i’s balance sheet at the year end is strong, with gearing at a

relatively low 28%, providing the financial capacity and

flexibility to vary investment and realisation activity in line

with market conditions.

|